Tesco 2006 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2006 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

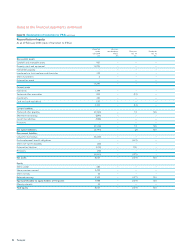

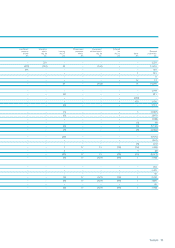

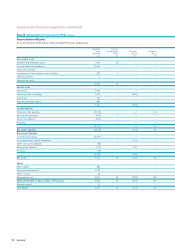

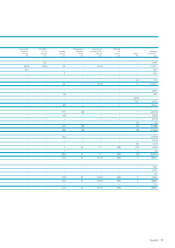

102 Tesco plc

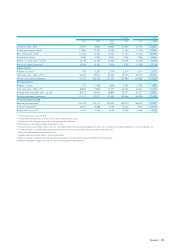

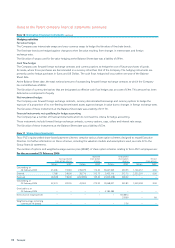

Five year record

UK GAAP IFRS

2002 2003 2004 2005 2005120062

53 wks

Financial statistics

Group sales (£m) 25,401 28,280 33,557 37,070 36,957 43,137

Revenue excluding VAT (£m)

UK 19,821 21,309 24,760 27,146 27,146 29,990

Rest of Europe 2,181 2,664 3,385 3,818 3,818 5,095

Asia 1,398 2,031 2,669 3,010 2,902 4,369

23,400 26,004 30,814 33,974 33,866 39,454

Operating profit3(£m)

UK 1,215 1,289 1,486 1,666 1,556 1,788

Rest of Europe 90 134 171 249 243 263

Asia 17 69 121 149 153 229

Total Group 1,322 1,492 1,778 2,064 1,952 2,280

Operating profit margin3

UK 6.1% 6.0% 6.0% 6.1% 5.7% 6.0%

Rest of Europe 4.1% 5.0% 5.1% 6.5% 6.4% 5.2%

Asia 1.2% 3.4% 4.5% 5.0% 5.3% 5.2%

Total Group 5.6% 5.7% 5.8% 6.1% 5.8% 5.8%

Goodwill amortisation (£m) (10) (23) (54) (67) – –

Share of results of Joint ventures and Associates4(£m) 22 42 59 69 74 82

Net finance costs4(£m) (140) (166) (209) (136) (132) (127)

Profit before tax (£m) 1,194 1,345 1,574 1,930 1,894 2,235

Taxation4(£m) (364) (399) (472) (561) (541) (649)

Minorityinterests (£m) – – (2) (3) (3) (6)

Loss for the period from discontinuing operation5(£m) – – – – (6) (10)

Profit for the financial year attributable to

equity holders of the parent (£m) 830 946 1,100 1,366 1,344 1,570

Underlying profit – UK GAAP6(£m) 1,221 1,401 1,708 2,029 N/a N/a

Underlying profit – IFRS6(£m) N/a N/a N/a N/a 1,925 2,277

1The 2005 IFRS financial statistics have been restated to remove the Taiwanese business which is held for sale.

2Results for the year ended 25 February 2006 include 52 weeks for the UK and ROI and 14 months for International.

3Operating profit includes integration costs and profit/(loss) arising on sale of fixed assets. Operating margin is based upon revenue exclusive of VAT.

4Share of results of Joint ventures and Associates is stated net of the interest and tax of the Group’s JVs and Associates. The Group’s charges for interest and tax have been

reduced by these amounts.

5Consists of the net result of the Taiwanese business which is held for sale.

6UK GAAP underlying profit excluded net profit/(loss) on disposal of fixed assets, integration costs and goodwill amortisation. IFRS underlying profit excludes IAS 32 and IAS 39

and the IAS 19 charge for defined benefit pension schemes, which is replaced by the normal cash contributions. For the years 2002 to 2005 the above information is

presented under UK GAAP as previously published. If IFRSs had been applicable for these years the main adjustments would have been similar to those in Note 32.