TCF Bank 2014 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2014 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

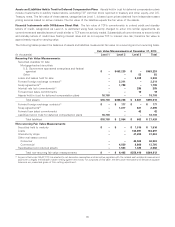

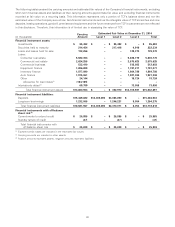

Note 17. Financial Instruments with Off-Balance Sheet Risk

TCF is a party to financial instruments with off-balance sheet risk, primarily to meet the financing needs of its customers. These

financial instruments, which are issued or held for purposes other than trading, involve elements of credit and interest-rate risk in

excess of the amount recognized in the Consolidated Statements of Financial Condition.

TCF’s exposure to credit loss, in the event of non-performance by the counterparty to the financial instrument, for commitments

to extend credit and standby letters of credit is represented by the contractual amount of the commitments. TCF uses the same

credit policies in making these commitments as it does for making direct loans. TCF evaluates each customer’s creditworthiness

on a case-by-case basis. The amount of collateral obtained is based on a credit evaluation of the customer.

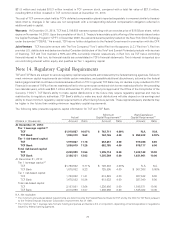

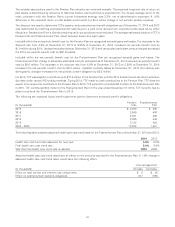

Financial instruments with off-balance sheet risk are summarized as follows.

At December 31,

(In thousands) 2014 2013

Commitments to extend credit:

Consumer real estate and other $1,314,826 $1,274,006

Commercial 609,618 482,777

Leasing and equipment finance 140,261 158,321

Total commitments to extend credit 2,064,705 1,915,104

Standby letters of credit and guarantees on industrial revenue bonds 14,676 13,364

Total $2,079,381 $1,928,468

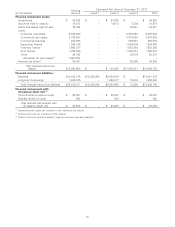

Commitments to Extend Credit Commitments to extend credit are agreements to lend provided there is no violation of any

condition in the contract. These commitments generally have fixed expiration dates or other termination clauses and may require

payment of a fee. Since certain of the commitments are expected to expire without being drawn upon, the total commitment

amounts do not necessarily represent future cash requirements. Collateral to secure any funding of these commitments

predominantly consists of residential and commercial real estate.

Standby Letters of Credit and Guarantees on Industrial Revenue Bonds Standby letters of credit and guarantees on

industrial revenue bonds are conditional commitments issued by TCF guaranteeing the performance of a customer to a third

party. These conditional commitments expire in various years through 2018. Collateral held consists primarily of commercial real

estate mortgages. Since the conditions under which TCF is required to fund these commitments may not materialize, the cash

requirements are expected to be less than the total outstanding commitments.

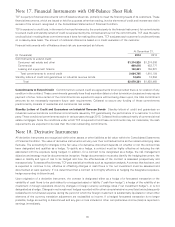

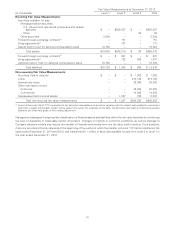

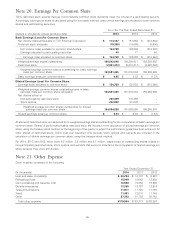

Note 18. Derivative Instruments

All derivative instruments are recognized within other assets or other liabilities at fair value within the Consolidated Statements

of Financial Condition. The value of derivative instruments will vary over their contractual terms as the related underlying rates

fluctuate. The accounting for changes in the fair value of a derivative instrument depends on whether or not the contract has

been designated and qualifies as a hedge. To qualify as a hedge, a contract must be highly effective at reducing the risk

associated with the exposure being hedged. In addition, for a contract to be designated as a hedge, the risk management

objective and strategy must be documented at inception. Hedge documentation must also identify the hedging instrument, the

asset or liability and type of risk to be hedged and how the effectiveness of the contract is assessed prospectively and

retrospectively. To assess effectiveness, TCF uses statistical methods such as regression analysis. A contract that has been, and

is expected to continue to be, effective at offsetting changes in cash flows or the net investment must be assessed and

documented at least quarterly. If it is determined that a contract is not highly effective at hedging the designated exposure,

hedge accounting is discontinued.

Upon origination of a derivative instrument, the contract is designated either as a hedge of a forecasted transaction or the

variability of cash flows to be paid related to a recognized asset or liability (‘‘cash flow hedge’’), a hedge of the volatility of an

investment in foreign operations driven by changes in foreign currency exchange rates (‘‘net investment hedge’’), or is not

designated as a hedge. Changes in net investment hedges recorded within other comprehensive income (loss) are subsequently

reclassified to non-interest expense during the period in which the foreign investment is substantially liquidated or when other

elements of the currency translation adjustment are reclassified to income. If a hedged forecasted transaction is no longer

probable, hedge accounting is discontinued and any gain or loss included in other comprehensive income (loss) is reported in

earnings immediately.

85