TCF Bank 2014 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2014 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

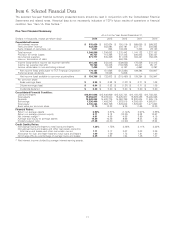

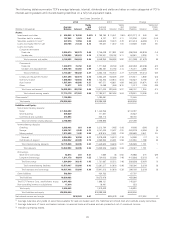

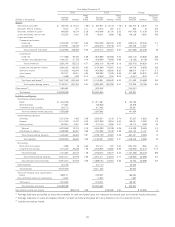

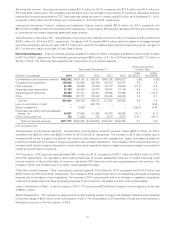

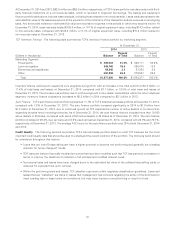

The following tables summarize TCF’s average balances, interest, dividends and yields and rates on major categories of TCF’s

interest-earning assets and interest-bearing liabilities on a fully tax-equivalent basis.

Year Ended December 31,

2014 2013 Change

Yields Yields Yields and

Average and Average and Average Rates

(Dollars in thousands) Balance Interest Rates Balance Interest Rates Balance Interest (bps)

Assets:

Investments and other $ 586,803 $ 15,390 2.62% $ 768,180 $ 15,041 1.96% $(181,377) $ 349 66

Securities held to maturity 197,943 5,281 2.67 6,737 277 4.11 191,206 5,004 (144)

Securities available for sale(1) 447,016 11,994 2.68 648,630 18,074 2.79 (201,614) (6,080) (11)

Loans and leases held for sale 259,186 21,128 8.15 155,337 11,647 7.50 103,849 9,481 65

Loans and leases:

Consumer real estate:

Fixed-rate 3,359,670 190,973 5.68 3,746,029 217,891 5.82 (386,359) (26,918) (14)

Variable-rate 2,788,882 143,431 5.14 2,703,921 138,192 5.11 84,961 5,239 3

Total consumer real estate 6,148,552 334,404 5.44 6,449,950 356,083 5.52 (301,398) (21,679) (8)

Commercial:

Fixed-rate 1,469,579 73,752 5.02 1,771,959 93,760 5.29 (302,380) (20,008) (27)

Variable- and adjustable-rate 1,665,788 66,450 3.99 1,490,787 61,752 4.14 175,001 4,698 (15)

Total commercial 3,135,367 140,202 4.47 3,262,746 155,512 4.77 (127,379) (15,310) (30)

Leasing and equipment finance 3,531,256 166,974 4.73 3,260,425 162,035 4.97 270,831 4,939 (24)

Inventory finance 1,888,080 112,603 5.96 1,723,253 103,844 6.03 164,827 8,759 (7)

Auto finance 1,567,904 68,595 4.37 907,571 43,921 4.84 660,333 24,674 (47)

Other 12,071 931 7.71 13,088 1,060 8.10 (1,017) (129) (39)

Total loans and leases(2) 16,283,230 823,709 5.06 15,617,033 822,455 5.27 666,197 1,254 (21)

Total interest-earning assets 17,774,178 877,502 4.94 17,195,917 867,494 5.04 578,261 10,008 (10)

Other assets(3) 1,124,226 1,092,681 31,545

Total assets $18,898,404 $18,288,598 $ 609,806

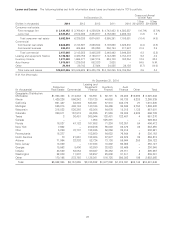

Liabilities and Equity:

Non-interest bearing deposits:

Retail $ 1,546,453 $ 1,442,356 $ 104,097

Small business 806,649 771,827 34,822

Commercial and custodial 413,893 345,713 68,180

Total non-interest bearing deposits 2,766,995 2,559,896 207,099

Interest-bearing deposits:

Checking 2,328,402 921 0.04 2,313,794 1,485 0.06 14,608 (564) (2)

Savings 5,693,751 8,343 0.15 6,147,030 12,437 0.20 (453,279) (4,094) (5)

Money market 1,312,483 7,032 0.54 818,814 2,391 0.29 493,669 4,641 25

Subtotal 9,334,636 16,296 0.17 9,279,638 16,313 0.18 54,998 (17) (1)

Certificates of deposit 2,840,922 22,089 0.78 2,369,992 20,291 0.86 470,930 1,798 (8)

Total interest-bearing deposits 12,175,558 38,385 0.32 11,649,630 36,604 0.31 525,928 1,781 1

Total deposits 14,942,553 38,385 0.26 14,209,526 36,604 0.26 733,027 1,781 –

Borrowings:

Short-term borrowings 83,673 261 0.31 7,685 46 0.60 75,988 215 (29)

Long-term borrowings 1,311,176 19,954 1.52 1,724,002 25,266 1.46 (412,826) (5,312) 6

Total borrowings 1,394,849 20,215 1.45 1,731,687 25,312 1.46 (336,838) (5,097) (1)

Total interest-bearing liabilities 13,570,407 58,600 0.43 13,381,317 61,916 0.46 189,090 (3,316) (3)

Total deposits and borrowings 16,337,402 58,600 0.36 15,941,213 61,916 0.39 396,189 (3,316) (3)

Other liabilities 502,560 434,763 67,797

Total liabilities 16,839,962 16,375,976 463,986

Total TCF Financial Corp. stockholders’ equity 2,041,428 1,896,131 145,297

Non-controlling interest in subsidiaries 17,014 16,491 523

Total equity 2,058,442 1,912,622 145,820

Total liabilities and equity $18,898,404 $18,288,598 $ 609,806

Net interest income and margin $818,902 4.61 $805,578 4.68 $ 13,324 (7)

(1) Average balances and yields of securities available for sale are based upon the historical amortized cost and exclude equity securities.

(2) Average balances of loans and leases include non-accrual loans and leases and are presented net of unearned income.

(3) Includes operating leases.

22