TCF Bank 2014 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2014 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

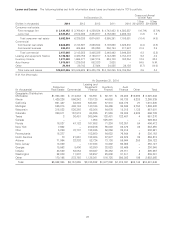

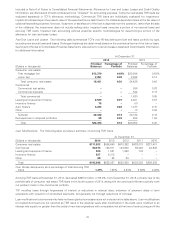

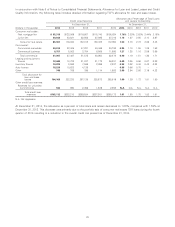

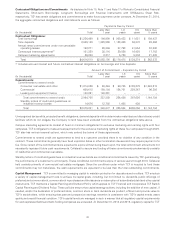

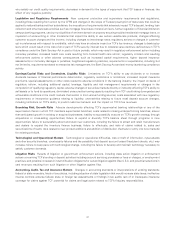

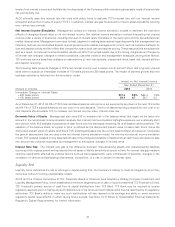

The following table sets forth a reconciliation of changes in the allowance for loan and lease losses.

Year Ended December 31,

(Dollars in thousands) 2014 2013 2012 2011 2010

Balance, beginning of period $ 252,230 $ 267,128 $ 255,672 $ 265,819 $ 244,471

Charge-offs:

Consumer real estate:

First mortgage lien (43,632) (60,363) (101,595) (94,724) (78,605)

Junior lien (19,494) (37,145) (83,190) (62,130) (56,125)

Total consumer real estate (63,126) (97,508) (184,785) (156,854) (134,730)

Commercial:

Commercial real estate (8,646) (28,287) (34,642) (32,890) (45,682)

Commercial business (11) (657) (6,194) (9,843) (4,045)

Total commercial (8,657) (28,944) (40,836) (42,733) (49,727)

Leasing and equipment finance (7,316) (7,277) (15,248) (16,984) (34,745)

Inventory finance (1,653) (1,141) (1,838) (1,044) (1,484)

Auto finance (11,856) (5,305) (1,164) – –

Other (8,359) (9,115) (10,239) (12,680) (16,377)

Total charge-offs (100,967) (149,290) (254,110) (230,295) (237,063)

Recoveries:

Consumer real estate:

First mortgage lien 1,513 2,055 1,067 510 2,237

Junior lien 5,354 6,589 4,582 3,233 2,633

Total consumer real estate 6,867 8,644 5,649 3,743 4,870

Commercial:

Commercial real estate 754 2,667 1,762 1,502 724

Commercial business 2,133 103 197 152 603

Total commercial 2,887 2,770 1,959 1,654 1,327

Leasing and equipment finance 3,705 3,968 5,058 4,461 4,100

Inventory finance 826 373 333 193 339

Auto finance 1,491 607 30 – –

Other 5,860 6,518 7,314 9,262 11,338

Total recoveries 21,636 22,880 20,343 19,313 21,974

Net charge-offs (79,331) (126,410) (233,767) (210,982) (215,089)

Provision charged to operations 95,737 118,368 247,443 200,843 236,437

Other(1) (104,467) (6,856) (2,220) (8) –

Balance, end of period $ 164,169 $ 252,230 $ 267,128 $ 255,672 $ 265,819

Net charge-offs as a percentage of average loans

and leases 0.49% 0.81% 1.54% 1.45% 1.47%

(1) Included in Other in 2014 is the transfer of $95.3 million, comprised of $77.0 million of previously established allowance for

loan and lease losses and an additional $18.3 million of write-downs arising from the transfer to loans held for sale in

conjunction with the portfolio sale of consumer real estate TDR loans.

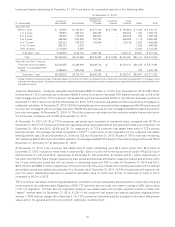

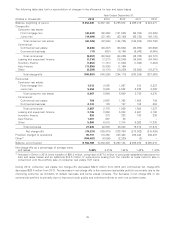

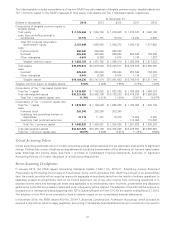

During 2014, consumer real estate net charge-offs decreased $32.6 million from 2013 and commercial net charge-offs

decreased $20.4 million from 2013. The decrease in net charge-offs in the consumer real estate portfolio is primarily due to the

improving economy, as incidents of default decrease and home values increase. The decrease in net charge-offs in the

commercial portfolio is primarily due to improved credit quality and continued efforts to work out problem loans.

39