TCF Bank 2014 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2014 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

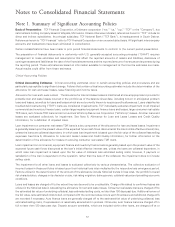

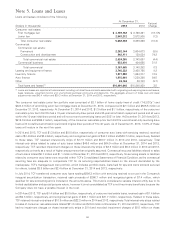

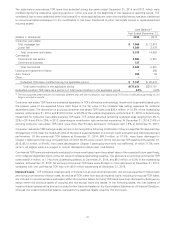

interest-only strips in 2013. Contractual recourse liabilities related to sales of consumer real estate loans totaled $0.6 million at

both December 31, 2014 and 2013. No servicing assets or liabilities related to consumer real estate loans were recorded within

TCF’s Consolidated Statements of Financial Condition, as the contractual servicing fees are adequate to compensate TCF for its

servicing responsibilities based on the amount demanded by the marketplace. During the fourth quarter of 2014, TCF sold

consumer real estate TDR loans totaling $405.9 million, received cash proceeds of $314.0 million and recognized losses of

$4.8 million which are included in the amounts above. TCF’s managed consumer real estate loan portfolio, which includes

portfolio loans, loans held for sale and loans sold and serviced for others, totaled $7.1 billion and $7.0 billion at December 31,

2014 and 2013, respectively.

From time to time, TCF sells leasing and equipment finance loans and minimum lease payment receivables to third-party financial

institutions at fixed rates. In 2014 and 2013, TCF sold $66.9 million and $60.3 million, respectively, of loans and minimum lease

payment receivables, received cash of $68.2 million and $62.1 million, respectively, and recognized net gains of $0.4 million and

$0.5 million, respectively. Related to these sales, TCF established servicing liabilities of $0.8 million and $1.3 million in 2014 and

2013, respectively. At December 31, 2014 and 2013, TCF had total servicing liabilities related to leasing and equipment finance of

$1.5 million and $1.7 million, respectively. At December 31, 2014 and 2013, TCF had lease residuals related to non-recourse

sales of $14.2 million and $15.2 million, respectively. TCF’s managed leasing and equipment finance loan portfolio, which

includes portfolio loans and leases, loans held for sale, operating leases and loans and leases sold and serviced for others, totaled

$4.0 billion and $3.7 billion at December 31, 2014 and 2013, respectively.

There were no material sales of commercial loans in 2014. In 2013, TCF sold $86.5 million of commercial loans and recognized a

net gain of $1.6 million, with no servicing liabilities related to these sales.

TCF’s agreements to sell auto and consumer real estate loans typically contain certain representations and warranties regarding

the loans sold. These representations and warranties generally relate to, among other things, the ownership of the loan, the

validity, priority and perfection of the lien securing the loan, accuracy of information supplied to the buyer, the loan’s compliance

with the criteria set forth in the agreement, payment delinquency and compliance with applicable laws and regulations. TCF may

be required to repurchase loans in the event of an unremedied breach of these representations or warranties. In 2014, 2013 and

2012, losses related to repurchases pursuant to such representations and warranties were immaterial. The majority of such

repurchases were of consumer auto loans where TCF typically has contractual agreements with the automobile dealerships that

originated the loans requiring the dealers to repurchase such contracts from TCF.

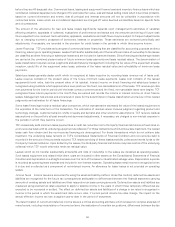

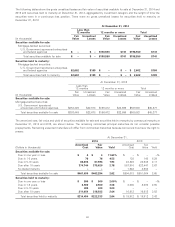

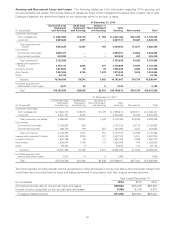

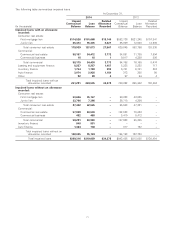

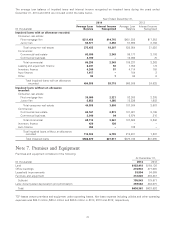

Future minimum lease payments receivable for direct financing, sales-type leases and operating leases as of December 31, 2014

are as follows:

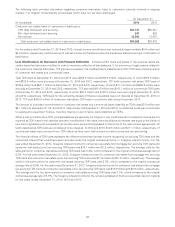

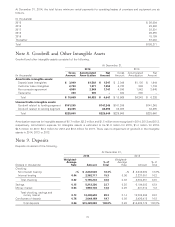

(In thousands)

2015 $ 711,813

2016 529,282

2017 365,547

2018 213,241

2019 105,650

Thereafter 36,949

Total $1,962,482

65