TCF Bank 2014 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2014 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

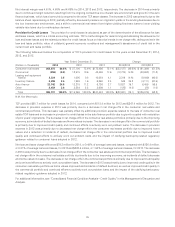

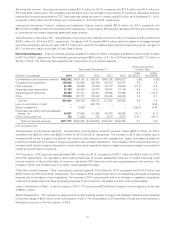

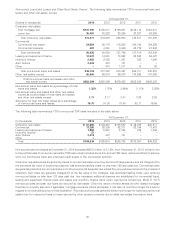

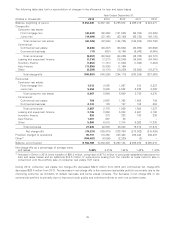

Included in Note 6 of Notes to Consolidated Financial Statements, Allowance for Loan and Lease Losses and Credit Quality

Information, are disclosures of loans considered to be ‘‘impaired’’ for accounting purposes. Consumer real estate TDR loans are

evaluated separately in TCF’s allowance methodology. Commercial TDR loans are individually evaluated for impairment.

Impairment is based upon the present value of the expected future cash flows or for collateral dependent loans at the fair value of

collateral less selling expense; however, if payment or satisfaction of the loan is dependent on the operation, rather than the sale

of the collateral, the impairment does not include selling costs. Impaired loans comprise a portion of non-accrual loans and

accruing TDR loans. Impaired loan accounting policies prescribe specific methodologies for determining a portion of the

allowance for loan and lease losses.

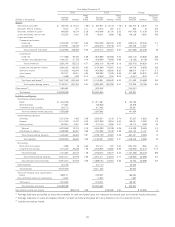

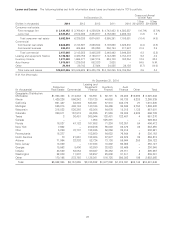

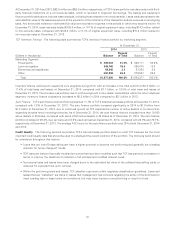

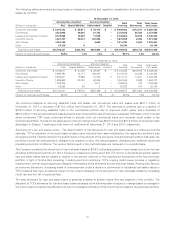

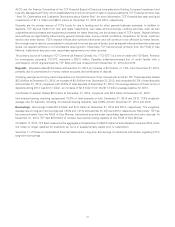

Past Due Loans and Leases The following table summarizes TCF’s over 60-day delinquent loan and lease portfolio by type,

excluding non-accrual loans and leases. Delinquent balances are determined based on the contractual terms of the loan or lease.

See Note 6 of Notes to Consolidated Financial Statements, Allowance for Loan and Lease Losses and Credit Quality Information,

for additional information.

At December 31,

2014 2013

Principal Percentage of Principal Percentage of

(Dollars in thousands) Balances Portfolio Balances Portfolio

Consumer real estate:

First mortgage lien $13,370 0.49% $20,894 0.58%

Junior lien 2,091 0.08 3,532 0.14

Total consumer real estate 15,461 0.30 24,426 0.40

Commercial:

Commercial real estate ––886 0.03

Commercial business ––544 0.14

Total commercial ––1,430 0.05

Leasing and equipment finance 2,549 0.07 2,401 0.07

Inventory finance 75 – 50 –

Auto finance 4,263 0.22 1,877 0.15

Other ––10 0.04

Subtotal 22,348 0.14 30,194 0.19

Delinquencies in acquired portfolios 88 0.03 458 1.64

Total $22,436 0.14 $30,652 0.20

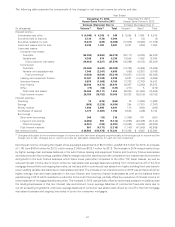

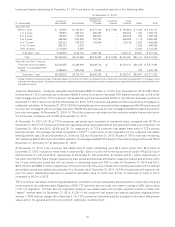

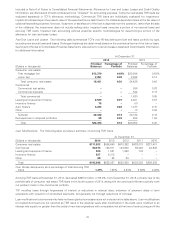

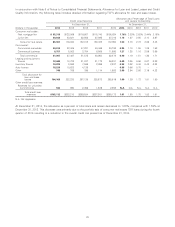

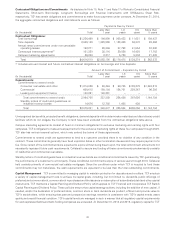

Loan Modifications The following table provides a summary of accruing TDR loans.

At December 31,

(Dollars in thousands) 2014 2013 2012 2011 2010

Consumer real estate $111,933 $506,640 $478,262 $433,078 $337,401

Commercial 80,375 120,871 144,508 98,448 48,838

Leasing and equipment finance 924 1,021 1,050 776 –

Inventory finance 527 4,212 – – –

Other 89 93 38 – –

Total $193,848 $632,837 $623,858 $532,302 $386,239

Over 60-day delinquency as a percentage of total accruing TDR

loans 1.39% 1.28% 4.34% 5.69% 4.64%

Accruing TDR loans at December 31, 2014, decreased $439.0 million, or 69.4%, from December 31, 2013, primarily due to the

portfolio sale of consumer real estate TDR loans in the fourth quarter of 2014, along with the continued efforts to actively work

out problem loans in the commercial portfolio.

TCF modifies loans through forgiveness of interest or reductions in interest rates, extension of payment dates or term

extensions with reduction of contractual payments, but generally not through reductions of principal.

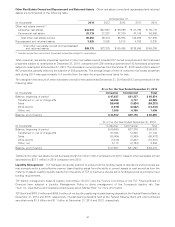

Loan modifications to borrowers who have not been granted concessions are not included in the table above. Loan modifications

to troubled borrowers are not reported as TDR loans in the calendar years after modification if the loans were modified to an

interest rate equal to or greater than the yields of new loan originations with comparable risk at the time of restructuring and if the

33