TCF Bank 2014 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2014 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

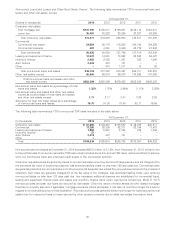

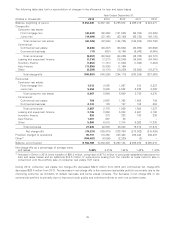

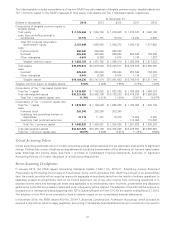

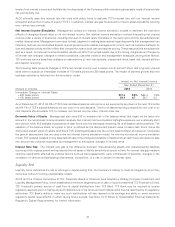

The following table includes reconciliations of the non-GAAP financial measures of tangible common equity, tangible assets and

Tier 1 common capital to the GAAP measures of total equity, total assets and Tier 1 risk-based capital, respectively.

At December 31,

(Dollars in thousands) 2014 2013 2012 2011 2010

Computation of tangible common equity to

tangible assets:

Total equity $ 2,135,364 $ 1,964,759 $ 1,876,643 $ 1,878,627 $ 1,480,163

Less: Non-controlling interest in

subsidiaries 13,715 11,791 13,270 10,494 8,500

Total TCF Financial Corporation

stockholders’ equity 2,121,649 1,952,968 1,863,373 1,868,133 1,471,663

Less:

Preferred stock 263,240 263,240 263,240 – –

Goodwill 225,640 225,640 225,640 225,640 152,599

Other intangibles 4,641 6,326 8,674 7,134 1,232

Tangible common equity $ 1,628,128 $ 1,457,762 $ 1,365,819 $ 1,635,359 $ 1,317,832

Total assets $19,394,611 $18,379,840 $18,225,917 $18,979,388 $18,465,025

Less:

Goodwill 225,640 225,640 225,640 225,640 152,599

Other intangibles 4,641 6,326 8,674 7,134 1,232

Tangible assets $19,164,330 $18,147,874 $17,991,603 $18,746,614 $18,311,194

Tangible common equity to tangible assets 8.50% 8.03% 7.59% 8.72% 7.20%

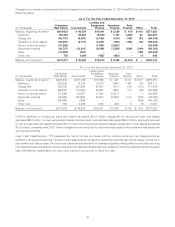

Computation of Tier 1 risk-based capital ratio:

Total Tier 1 capital $ 1,919,887 $ 1,763,682 $ 1,633,336 $ 1,706,926 $ 1,459,703

Total risk-weighted assets $16,321,425 $15,455,706 $14,733,203 $13,475,330 $13,936,629

Total Tier 1 risk-based capital ratio 11.76% 11.41% 11.09% 12.67% 10.47%

Computation of Tier 1 common capital ratio:

Total Tier 1 capital $ 1,919,887 $ 1,763,682 $ 1,633,336 $ 1,706,926 $ 1,459,703

Less:

Preferred stock 263,240 263,240 263,240 – –

Qualifying non-controlling interest in

subsidiaries 13,715 11,791 13,270 10,494 8,500

Qualifying trust preferred securities –– – 115,000 115,000

Total Tier 1 common capital $ 1,642,932 $ 1,488,651 $ 1,356,826 $ 1,581,432 $ 1,336,203

Total risk-weighted assets $16,321,425 $15,455,706 $14,733,203 $13,475,330 $13,936,629

Total Tier 1 common capital ratio 10.07% 9.63% 9.21% 11.74% 9.59%

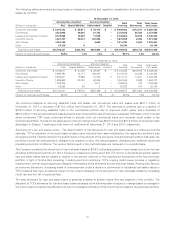

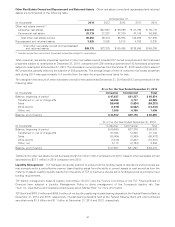

Critical Accounting Policies

Critical accounting estimates occur in certain accounting policies and procedures and are particularly susceptible to significant

change. Policies that contain critical accounting estimates include the determination of the allowance for loan and lease losses,

lease financings and income taxes. See Note 1 of Notes to Consolidated Financial Statements, Summary of Significant

Accounting Policies, for further discussion of critical accounting policies.

Recent Accounting Developments

In January 2015, the FASB issued Accounting Standards Update (‘‘ASU’’) No. 2015-01, Simplifying Income Statement

Presentation by Eliminating the Concept of Extraordinary Items, which eliminates from GAAP the concept of an extraordinary

item. As a result, an entity will no longer be required to segregate extraordinary items from the results of ordinary operations, to

separately present an extraordinary item on its income statement, net of tax, after income from continuing operations or to

disclose income taxes and earnings per share data applicable to an extraordinary item. However, presentation and disclosure

guidance for items that are unusual in nature and occur infrequently will be retained. The adoption of this ASU will be required on

a prospective or retrospective basis beginning with TCF’s Quarterly Report on Form 10-Q for the quarter ending March 31, 2016.

The adoption of this ASU is not expected to have a material impact on our consolidated financial statements.

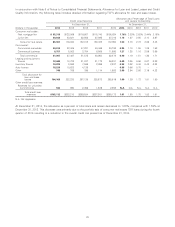

In November 2014, the FASB issued ASU No. 2014-17, Business Combinations: Pushdown Accounting, which provides an

acquired entity with an option to apply pushdown accounting in its separate financial statements upon occurrence of an event in

44