TCF Bank 2014 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2014 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

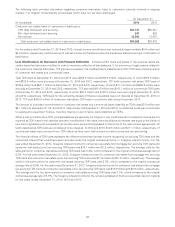

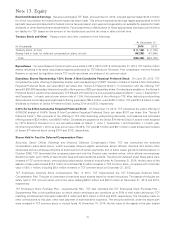

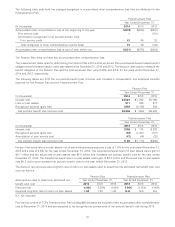

$31.8 million and included $18.3 million invested in TCF common stock, compared with a total fair value of $27.8 million,

including $16.4 million invested in TCF common stock at December 31, 2013.

The cost of TCF common stock held by TCF’s deferred compensation plans is reported separately in a manner similar to treasury

stock (that is, changes in fair value are not recognized) with a corresponding deferred compensation obligation reflected in

additional paid-in capital.

Warrants At December 31, 2014, TCF had 3,199,988 warrants outstanding with an exercise price of $16.93 per share, which

expire on November 14, 2018. Upon the completion of the U.S. Treasury’s secondary public offering of the warrants issued under

the Capital Purchase Program (‘‘CPP’’) in December 2009, the warrants became publicly traded on the New York Stock Exchange

under the symbol ‘‘TCBWS,’’ As a result, TCF has no further obligations to the Federal Government in connection with the CPP.

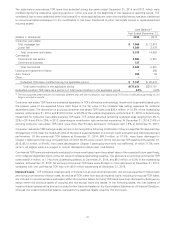

Joint Venture TCF has a joint venture with The Toro Company (‘‘Toro’’) called Red Iron Acceptance, LLC (‘‘Red Iron’’). Red Iron

provides U.S. distributors and dealers and select Canadian distributors of the Toro and Exmark branded products with sources

of financing. TCF and Toro maintain a 55% and 45% ownership interest, respectively, in Red Iron. As TCF has a controlling

financial interest in Red Iron, its financial results are consolidated in TCF’s financial statements. Toro’s interest is reported as a

non-controlling interest within equity and qualifies as Tier 1 regulatory capital.

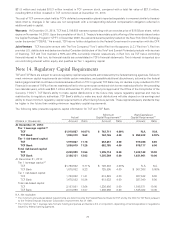

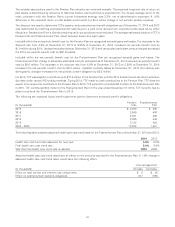

Note 14. Regulatory Capital Requirements

TCF and TCF Bank are subject to various regulatory capital requirements administered by the federal banking agencies. Failure to

meet minimum capital requirements can initiate certain mandatory, and possible additional discretionary, actions by the federal

banking agencies that could have a material adverse effect on TCF. In general, TCF Bank may not declare or pay a dividend to TCF

Financial in excess of 100% of its net retained profits for the current year combined with its net retained profits for the preceding

two calendar years, which was $83.7 million at December 31, 2014, without prior approval of the Office of the Comptroller of the

Currency (‘‘OCC’’). TCF Bank’s ability to make capital distributions in the future may require regulatory approval and may be

restricted by its regulatory authorities. TCF Bank’s ability to make any such distributions will also depend on its earnings and

ability to meet minimum regulatory capital requirements in effect during future periods. These capital adequacy standards may

be higher in the future than existing minimum regulatory capital requirements.

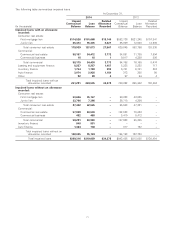

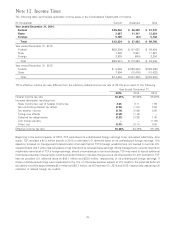

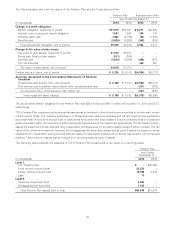

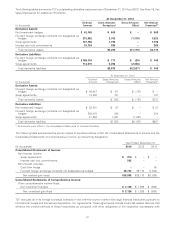

The following table presents regulatory capital information for TCF and TCF Bank.

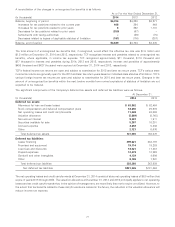

Minimum Well-Capitalized

Actual Capital Requirement(1) Capital Requirement(1)

(Dollars in thousands) Amount Ratio Amount Ratio Amount Ratio

At December 31, 2014:

Tier 1 leverage capital:(2)

TCF $1,919,887 10.07% $ 762,711 4.00% N.A. N.A.

TCF Bank 1,836,019 9.63 762,746 4.00 $ 953,432 5.00%

Tier 1 risk-based capital:

TCF 1,919,887 11.76 652,857 4.00 979,286 6.00

TCF Bank 1,836,019 11.25 652,785 4.00 979,177 6.00

Total risk-based capital:

TCF 2,209,999 13.54 1,305,714 8.00 1,632,143 10.00

TCF Bank 2,126,131 13.03 1,305,569 8.00 1,631,961 10.00

At December 31, 2013:

Tier 1 leverage capital:(2)

TCF $1,763,682 9.71% $ 726,242 4.00% N.A. N.A.

TCF Bank 1,675,082 9.23 725,895 4.00 $ 907,368 5.00%

Tier 1 risk-based capital:

TCF 1,763,682 11.41 618,228 4.00 927,342 6.00

TCF Bank 1,675,082 10.84 618,033 4.00 927,049 6.00

Total risk-based capital:

TCF 2,107,981 13.64 1,236,456 8.00 1,545,571 10.00

TCF Bank 2,018,959 13.07 1,236,066 8.00 1,545,082 10.00

N.A. Not Applicable.

(1) The minimum and well-capitalized requirements are determined by the Federal Reserve Board for TCF and by the OCC for TCF Bank pursuant

to the Federal Deposit Insurance Corporation Improvement Act of 1991.

(2) The minimum Tier 1 leverage ratio for bank holding companies and banks is 3.0 or 4.0 percent, depending on factors specified in regulations

issued by federal banking agencies.

79