TCF Bank 2014 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2014 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

4

manufacturers, primarily in the

powersports, lawn and garden,

appliances and electronics, and

marine industries. We nance the

inventory shipped to the retail

dealers of the manufacturers. Not

only do we have the inventory as

collateral, but we underwrite each

dealer’s credit and generally have

agreements with manufacturers to

reallocate repossessed inventory at

no loss to us. These loans turn very

quickly with an estimated weighted

average life of four months.

Inventory nance has been our best

performing business in terms of

losses, even during the recession.

Net charge-offs in 2014 were

0.04 percent while peak losses since

the business began were 0.17 percent

in 2010. This is a high credit quality

business because it has multiple

sources of credit support, including

the credit of the retailer, the value of

the collateral and the arrangements

with the manufacturers. In addition,

credit risk is spread across more than

9,600 active dealers in all 50 states

and Canada.

Auto nancing, on the other hand, is

a newer business which we have been

in for three years. We acquired the

business with a fully developed

origination and servicing platform, as

well as a seasoned management team

averaging 25 years of experience in

auto nance. Net charge-offs in 2014

were 0.66 percent. As the portfolio is

still maturing, losses may continue to

slowly increase and are expected to

stabilize around 75 basis points. The

biggest risks in the auto business are

a weak economy and falling auto

values. We mitigate these risks by

selling our lower FICO originations

and consistently underwriting with a

focus on all aspects of the transaction,

including credit, stability and ability

to pay. The current average FICO of

the portfolio loans is 724.

Our most seasoned national lending

business is Leasing and Equipment

Finance, which we have been in since

1997 with the acquisition of Winthrop

Resources Corporation, our high-tech

leasing company. Winthrop, TCF’s

highest ROA business, is able to

mitigate risk by nancing business-

essential equipment through high

credit quality borrowers. Our other

leasing business, TCF Equipment

Finance, is well diversied in select

segments such as specialty vehicles,

manufacturing, medical, construction

and technology. Together, these

businesses are well diversied by

equipment type and geography

with an average loan size of just

$74 thousand. These businesses had

net charge-offs of only 0.10 percent

in 2014 and are both run by very

experienced management teams.

Our legacy lending businesses,

commercial and retail lending, have

also added national lending

components in recent years. As part

of our commercial business, we

started TCF Capital Funding, an

asset-based and cash ow lending

business, in 2012. Similar to our other

businesses, TCF Capital Funding is run

by a very experienced management

team, which we recruited as a group,

and has seen no charge-offs since its

inception. Risks are mitigated by

secured lending and diverse

collateral types. While we are letting

our legacy rst residential mortgage

portfolio run off, we are originating

high-quality junior lien mortgages to

high FICO borrowers across the

United States. Risks are mitigated

through the portfolio’s strong loan-

to-value and debt-to-income ratios as

well as quarterly loan sales to manage

concentration risk. This portfolio had

no net charge-offs in 2014, nearly no

delinquencies and a current average

FICO of 742.

In late 2014, we further mitigated the

balance sheet credit risk of our legacy

retail portfolio by selling $405.9

million of consumer troubled debt

restructurings (“TDRs”) which

resulted in a $23.1 million pre-tax

charge. We expect to recover this

loss in less than three years through

reduced net charge-offs, lower

expenses and increased margin

created by redeploying funds into

higher yielding assets. We also

expect to see a quicker reduction

of non-performing assets moving

forward as the TDR sale will help to

TCF Financial Corporation and Subsidiaries

4

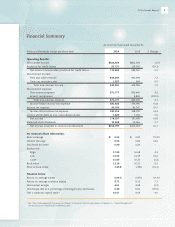

Loan & Lease Originations

Billions of Dollars

$5.2

10

$5.5

11

$10.8

12

$12.1

13

$13.5

14

Loan & Lease Portfolio

Billions of Dollars

$14.8

10

$14.2

11

$15.4

12

$15.8

13

$16.4

14

Consumer Real Estate and Other

Auto Finance

Commercial

Leasing and Equipment Finance

Inventory Finance