TCF Bank 2014 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2014 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

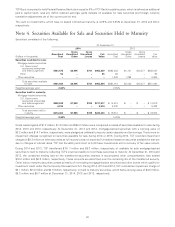

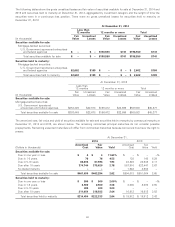

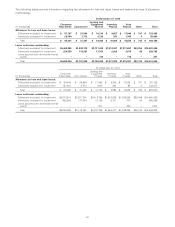

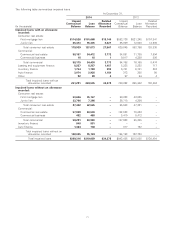

The following tables show the gross unrealized losses and fair value of securities available for sale at December 31, 2014 and

2013 and securities held to maturity at December 31, 2014, aggregated by investment category and the length of time the

securities were in a continuous loss position. There were no gross unrealized losses for securities held to maturity at

December 31, 2013.

At December 31, 2014

Less than

12 months 12 months or more Total

Fair Unrealized Fair Unrealized Fair Unrealized

(In thousands) Value Losses Value Losses Value Losses

Securities available for sale:

Mortgage-backed securities:

U.S. Government sponsored enterprises

and federal agencies $ – $ – $198,550 $741 $198,550 $741

Total securities available for sale $ – $ – $198,550 $741 $198,550 $741

Securities held to maturity:

Mortgage-backed securities:

U.S. Government sponsored enterprises

and federal agencies $2,602 $109 $ – $ – $ 2,602 $109

Total securities held to maturity $2,602 $109 $ – $ – $ 2,602 $109

At December 31, 2013

Less than

12 months 12 months or more Total

Fair Unrealized Fair Unrealized Fair Unrealized

(In thousands) Value Losses Value Losses Value Losses

Securities available for sale:

Mortgage-backed securities:

U.S. Government sponsored

enterprises and federal agencies $353,449 $22,678 $156,472 $22,699 $509,921 $45,377

Total securities available for sale $353,449 $22,678 $156,472 $22,699 $509,921 $45,377

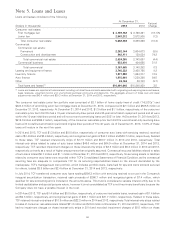

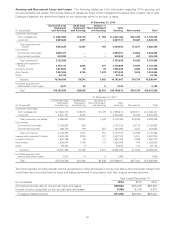

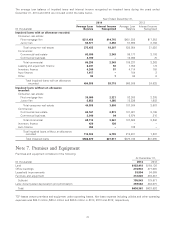

The amortized cost, fair value and yield of securities available for sale and securities held to maturity by contractual maturity at

December 31, 2014 and 2013, are shown below. The remaining contractual principal maturities do not consider possible

prepayments. Remaining expected maturities will differ from contractual maturities because borrowers may have the right to

prepay.

At December 31,

2014 2013

Amortized Fair Amortized Fair

(Dollars in thousands) Cost Value Yield Cost Value Yield

Securities available for sale:

Due in one year or less $ 4 $ 4 11.63% $–$– –%

Due in 1-5 years 76 76 4.53 138 140 5.24

Due in 5-10 years 86,806 87,594 1.93 24,328 24,543 2.17

Due after 10 years 374,744 375,620 2.78 567,910 523,447 2.67

No stated maturity –––1,642 2,934 –

Total securities available for sale $461,630 $463,294 2.62 $594,018 $551,064 2.65

Securities held to maturity:

Due in one year or less $ 500 $ 500 2.00% $–$– –%

Due in 1-5 years 2,500 2,500 3.08 3,000 3,000 2.90

Due in 5-10 years 400 400 3.00 –––

Due after 10 years 211,054 218,933 2.64 16,912 16,912 3.52

Total securities held to maturity $214,454 $222,333 2.64 $ 19,912 $ 19,912 3.43

63