Supercuts 2012 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2012 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

1. BUSINESS DESCRIPTION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

Employee Termination Expense:

During fiscal year 2012, the Company reduced the home office workforce by approximately 120 employees. The Company recorded

$9.8 million in senior management restructuring and other severance charges. In addition the Company recorded $2.8 million in other

restructuring charges associated with one-time costs of implementing the Company's new strategy.

Recent Accounting Standards Adopted by the Company:

Disclosures about Fair Value of Financial Instruments

In January 2010, the Financial Accounting Standards Board (FASB) issued guidance to amend the disclosure requirements related to

recurring and nonrecurring fair value measurements. The guidance requires a roll forward of activities, presented separately on a gross basis, on

purchases, sales, issuance, and settlements of the assets and liabilities measured using significant unobservable inputs (Level 3 fair value

measurements). The Company adopted the new disclosure guidance related to Level 3 fair value measurements, including the disclosure on the

roll forward activities, on July 1, 2011.

Fair Value Measurement

In May 2011, the FASB issued guidance to achieve common fair value measurement and disclosure requirements between GAAP and

International Financial Reporting Standards. This new guidance amends current fair value measurement and disclosure guidance to include

increased transparency around valuation inputs and investment categorization. This new guidance is effective for fiscal years and interim

periods beginning after December 15, 2011. The Company adopted the guidance on January 1, 2012.

Accounting Standards Recently Issued But Not Yet Adopted by the Company:

Testing Goodwill for Impairment

In September 2011, the FASB issued guidance to allow an entity to first assess qualitative factors to determine whether it is necessary to

perform the two-step quantitative goodwill impairment test. If after assessing the totality of events or circumstances, an entity determines it is

not more likely than not that the fair value of a reporting unit is less than its carrying amount, then performing the two-step impairment test is

not required. This new guidance is effective for annual and interim goodwill impairment tests performed for fiscal years beginning after

December 15, 2011. The Company will adopt the guidance on July 1, 2012 but does not expect it to have a material impact on the Company's

financial position, results of operations or cash flows.

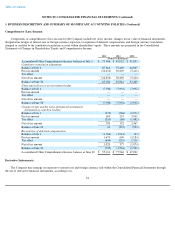

Comprehensive Income

In June 2011, the FASB issued guidance on the presentation of comprehensive income. Specifically, the new guidance allows an entity to

present components of net income and other comprehensive income in one continuous statement, referred to as the statement of comprehensive

income, or in two separate, but consecutive statements. The new guidance eliminates the current option to report other comprehensive income

and its components in the statement of changes in equity. While the new guidance changes the presentation of comprehensive income, there are

no changes to the components that are recognized in net income or other comprehensive income under current

96