Supercuts 2012 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2012 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

1. BUSINESS DESCRIPTION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

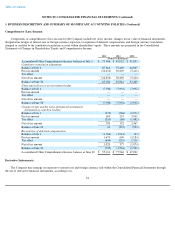

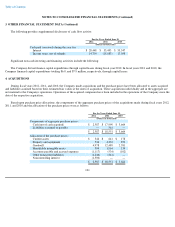

Comprehensive (Loss) Income:

Components of comprehensive (loss) income for the Company include net (loss) income, changes in fair value of financial instruments

designated as hedges of interest rate or foreign currency exposure, recognition of deferred compensation, and foreign currency translation

charged or credited to the cumulative translation account within shareholders' equity. These amounts are presented in the Consolidated

Statements of Changes in Shareholders' Equity and Comprehensive Income.

Derivative Instruments:

The Company may manage its exposure to interest rate and foreign currency risk within the Consolidated Financial Statements through

the use of derivative financial instruments, according to its

94

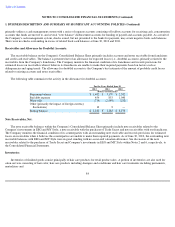

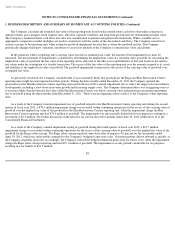

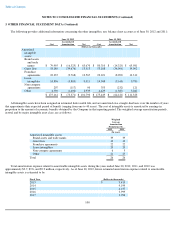

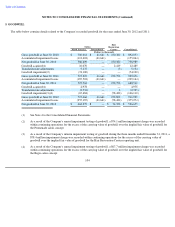

2012 2011 2010

(Dollars in thousands)

Accumulated Other Comprehensive Income, balance at July 1

$

77,946

$

47,032

$

51,855

Cumulative translation adjustment:

Balance at July 1

87,814

57,409

62,825

Pre

-

tax amount

(24,254

)

30,405

(5,416

)

Tax effect

—

—

—

Net of tax amount

(24,254

)

30,405

(5,416

)

Balance at June 30

63,560

87,814

57,409

Unrecognized loss on net investment hedge:

Balance at July 1

(7,932

)

(7,932

)

(7,932

)

Pre

-

tax amount

—

—

—

Tax effect

—

—

—

Net of tax amount

—

—

—

Balance at June 30

(7,932

)

(7,932

)

(7,932

)

Changes in fair market value of financial instruments

designated as cash flow hedges:

Balance at July 1

(372

)

(504

)

(2,971

)

Pre

-

tax amount

603

218

3,949

Tax effect

(210

)

(86

)

(1,482

)

Net of tax amount

393

132

2,467

Balance at June 30

21

(372

)

(504

)

Recognition of deferred compensation:

Balance at July 1

(1,564

)

(1,941

)

(67

)

Pre

-

tax amount

1,673

609

(3,184

)

Tax effect

(644

)

(232

)

1,310

Net of tax amount

1,029

377

(1,874

)

Balance at June 30

(535

)

(1,564

)

(1,941

)

Accumulated Other Comprehensive Income, balance at June 30

$

55,114

$

77,946

$

47,032