Supercuts 2012 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2012 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181

|

|

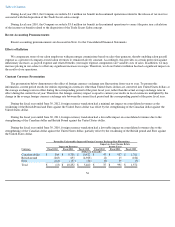

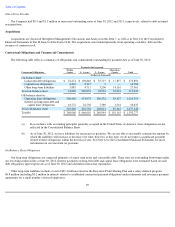

Table of Contents

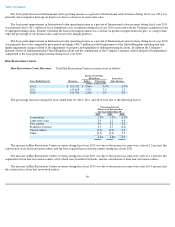

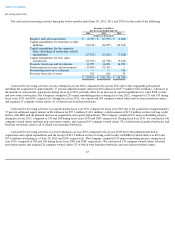

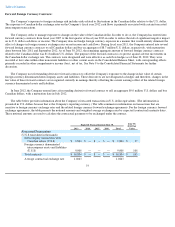

The company-owned constructed and acquired locations (excluding franchise buybacks) consisted of the following number of locations in

each concept:

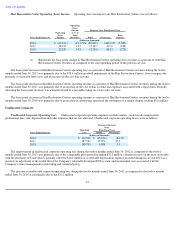

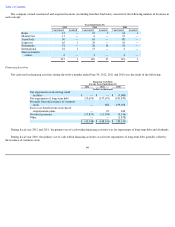

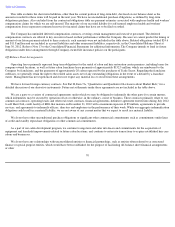

Financing Activities

Net cash used in financing activities during the twelve months ended June 30, 2012, 2011 and 2010 was the result of the following:

During fiscal year 2012 and 2011, the primary use of cash within financing activities was for repayments of long-term debt and dividends.

During fiscal year 2010, the primary use of cash within financing activities was for net repayments of long-term debt, partially offset by

the issuance of common stock.

66

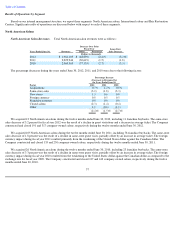

Years Ended June 30,

2012 2011 2010

Constructed Acquired Constructed Acquired Constructed Acquired

Regis

12

—

12

9

14

3

MasterCuts

11

—

6

—

15

—

SmartStyle

50

—

65

—

80

—

Supercuts

65

1

24

—

10

—

Promenade

53

—

26

18

18

—

International

18

1

13

—

2

—

Hair restoration

centers

6

—

3

—

4

—

215

2

149

27

143

3

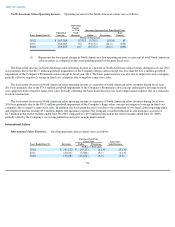

Financing Cash Flows

For the Years Ended June 30,

2012 2011 2010

(Dollars in thousands)

Net repayments on revolving credit

facilities

$

—

$

—

$

(

5,000

)

Net repayments of long

-

term debt

(29,693

)

(137,671

)

(181,850

)

Proceeds from the issuance of common

stock

—

682

159,498

Excess tax benefit from stock-based

compensation plans

—

67

243

Dividend payments

(13,855

)

(11,509

)

(9,146

)

Other

—

—

(

2,878

)

$

(43,548

)

$

(148,431

)

$

(39,133

)