Supercuts 2012 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2012 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

1. BUSINESS DESCRIPTION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

accounting guidance. This new guidance is effective for fiscal years and interim periods within those years beginning after December 15, 2011.

The Company will adopt the guidance on a retrospective basis on July 1, 2012. The guidance will not have a material impact on the Company's

financial position, results of operations or cash flows. However, it will require changing the Company's presentation and disclosure of

comprehensive income.

Disclosures about Offsetting Assets and Liabilities

In December 2011, the FASB issued new accounting disclosure requirements about the nature and exposure of offsetting arrangements

related to financial and derivative instruments. The requirements are effective for fiscal years beginning after January 1, 2013. The Company

will adopt the guidance on July 1, 2013. Other than requiring additional disclosures, the Company does not expect it to have a material impact

on the Company's results of operations or financial position.

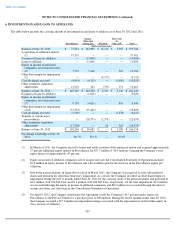

2. DISCONTINUED OPERATIONS

On February 16, 2009, the Company sold its Trade Secret salon concept (Trade Secret). The Company reported Trade Secret as a

discontinued operation.

The Company has a formal note receivable agreement with the purchaser of Trade Secret. The Company recorded a valuation reserve of

$31.2 million during fiscal year 2011. The carrying value of the note receivable was fully reserved as of June 30, 2011. The Company has

determined the collectibility of accrued interest on the note receivable to be less than probable. The Company suspended recognition of interest

income effective April 2010 and will use the cash basis method for recognizing future interest income. The Company did not receive interest

payments from the purchaser of Trade Secret during the twelve months ended June 30, 2012.

The purchaser of Trade Secret emerged from bankruptcy in March 2012 and in conjunction, the Company entered into a credit and

security agreement in which the principal balance of the note receivable was reduced from $35.7 to $18.0 million. Payments of $0.5 million are

due quarterly beginning on May 31, 2012. Upon receipt of the quarterly payments through February 2019 the remaining principal and unpaid

interest will be forgiven. Included in the agreement was a scheduled extraordinary principal payment to be made in the fourth quarter of fiscal

year 2012. The purchaser of Trade Secret satisfied the extraordinary principal payment during the fourth fiscal quarter of 2012 by returning

$0.8 million of inventory. The Company recorded the recovery of bad debt expense upon receipt of the inventory in June 2012. The principal

payment of $0.5 million due May 31, 2012, was not received as of June 30, 2012. The carrying value of the note receivable continues to be

fully reserved at June 30, 2012.

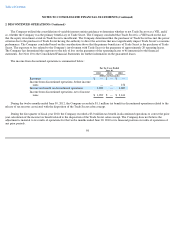

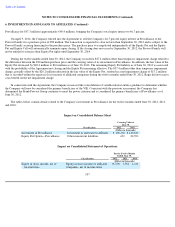

Effective in the second quarter of fiscal year 2010, the Company has an agreement in which the Company provides warehouse services to

the purchaser of Trade Secret. Under the warehouse services agreement, the Company recognized $1.5, $2.7 and $3.0 million of other income

related to warehouse services during the twelve months ended June 30, 2012, 2011 and 2010, respectively. The carrying value of the receivable

related to warehouse services was $0.2 and $0.3 million as of June 30, 2012 and 2011, respectively.

97