Supercuts 2012 Annual Report Download - page 160

Download and view the complete annual report

Please find page 160 of the 2012 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

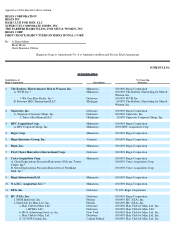

1.15. Schedule 8G-2 — More Restrictive Agreements is added to the Shelf Agreement in the form of Schedule 8G-2 — More

Restrictive Agreements attached to this letter.

SECTION 2. Conditions Precedent . This letter shall become effective as of the date (the “ Effective Date ”) when the

following conditions have been satisfied:

2.1. Documents

. PIM and each holder of the Notes party hereto shall have received an original counterpart hereof duly executed

by the Company, the Guarantors and the Required Holder(s) of the Notes of each Series. The foregoing documentation should be returned to

Prudential Capital Group, Two Prudential Plaza, Suite 5600, Chicago, Illinois, 60601-6716, Attention: Scott B. Barnett.

2.2. Representations and Warranties; No Default . To induce the holders of the Notes to execute and deliver this letter, the

Company represents, warrants and covenants that (1) the execution and delivery of this letter has been duly authorized by all necessary

corporate action on behalf of each Company and each Guarantor and this letter has been executed and delivered by a duly authorized officer of

each Company and each Guarantor, and all necessary or required consents to and approvals of this letter have been obtained and are in full

force and effect, (2) the representations and warranties contained in paragraph 8 of the Shelf Agreement shall be true on and as of the Effective

Date, immediately before and after giving effect to the consummation of the transactions contemplated hereby, (3) the Shelf Agreement, as

amended hereby, is the legal, valid and binding obligation of the Company, enforceable against the Company in accordance with its terms

except as enforceability thereof may be limited by applicable bankruptcy, insolvency, reorganization, moratorium or similar laws affecting the

enforcement of creditors’ rights generally and by the availability of the remedy of specific performance, (4) the Subsidiaries of the Company

party to this letter represent all of the Subsidiaries of the Company that have joined the Guaranty Agreement (as defined in Section 4 below),

and (5) there shall exist on the Effective Date no Event of Default or Default, immediately before and after giving effect to the consummation

of the transactions contemplated hereby.

2.3. Proceedings . All corporate and other proceedings taken or to be taken in connection with the transactions contemplated

hereby and all documents incident thereto shall be satisfactory in substance and form to the Required Holder(s) of each Series, and each holder

of the Notes party hereto shall have received all such counterpart originals or certified or other copies of such documents as it may reasonably

request.

SECTION 3. Reference to and Effect on Shelf _Agreement . Upon the effectiveness of this letter, each reference to the Shelf

Agreement in any other document, instrument or agreement shall mean and be a reference to the Shelf Agreement as modified by this letter.

Except as specifically set forth in Section 1 hereof, the Shelf Agreement and the Notes shall remain in full force and effect and is hereby

ratified and confirmed in all respects. Except as specifically stated in this letter, the execution, delivery and effectiveness of this letter shall not

(a) amend the Shelf Agreement or any Note, (b) operate as a waiver of any right, power or remedy of PIM or any holder of the Notes, or (c)

constitute a waiver of, or consent to any departure from, any provision of the Shelf Agreement or any Note at any time. The Company

acknowledges and agrees that neither PIM nor any holder of any Note is under any duty or obligation of any kind or nature whatsoever to grant

the Company any additional amendments or

6

waivers of any type, whether under the same or different circumstances, and no course of dealing or course of performance shall be deemed to

have occurred as a result of the amendments and wavier herein.

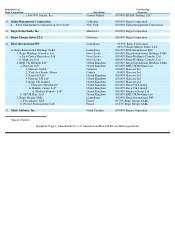

SECTION 4. Reaffirmation . Each Guarantor (as defined in the Amended and Restated Subsidiary Guaranty dated

February 23, 2003 (the “ Guaranty Agreement ”) by certain Subsidiaries of the Company in favor of the holders of the Notes) hereby ratifies

and reaffirms all of its payment and performance obligations, contingent or otherwise, under the Guaranty Agreement. Each Guarantor hereby

consents to the terms and conditions of this letter and reaffirms its obligations and liabilities under or with respect to the Shelf Agreement and

the Notes, each as amended by this letter (including, without limitation, any additional Guaranteed Obligations (as defined in the Guaranty

Agreement) resulting from this letter), and the Guaranty Agreement. Each Guarantor acknowledges that the Guaranty Agreement remains in

full force and effect and is hereby ratified and confirmed. Without limiting the generality of the foregoing, each Guarantor agrees and confirms

that the Guaranty Agreement continues to guaranty the Guaranteed Obligations arising under or in connection with the Shelf Agreement and

the Notes, each as amended by this letter. The execution of this letter shall not operate as a novation, waiver of any right, power or remedy of

the holders of the Notes under the Guaranty Agreement.

SECTION 5. Expenses . The Company hereby confirms its obligations under the Shelf Agreement, whether or not the

transactions hereby contemplated are consummated, to pay, promptly after request by any holder of the Notes, all reasonable out-of-pocket

costs and expenses, including attorneys’

fees and expenses, incurred by any holder of the Notes in connection with this letter or the transactions

contemplated hereby, in enforcing any rights under this letter, or in responding to any subpoena or other legal process or informal investigative

demand issued in connection with this letter or the transactions contemplated hereby. The obligations of the Company under this Section 5

shall survive transfer by any holder of the Notes of any Note and payment of any Note.

SECTION 6. Governing Law . THIS LETTER SHALL BE CONSTRUED AND ENFORCED IN ACCORDANCE

WITH, AND THE RIGHTS OF THE PARTIES SHALL BE GOVERNED BY, THE LAW OF THE STATE OF ILLINOIS

(EXCLUDING ANY CONFLICTS OF LAW RULES WHICH WOULD OTHERWISE CAUSE THIS AGREEMENT TO BE

CONSTRUED OR ENFORCED IN ACCORDANCE WITH, OR THE RIGHTS OF THE PARTIES TO BE GOVERNED BY, THE

LAWS OF ANY OTHER JURISDICTION).