Supercuts 2012 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2012 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

12. INCOME TAXES

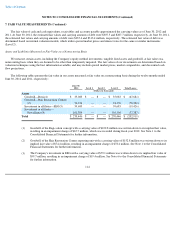

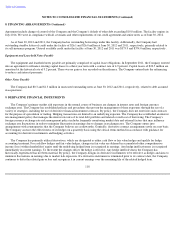

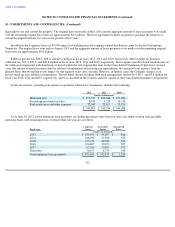

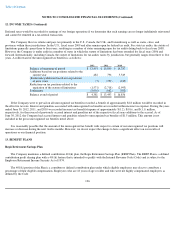

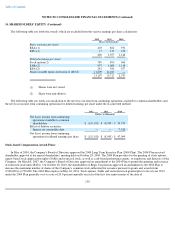

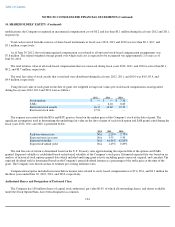

The components of (loss) income before income taxes are as follows:

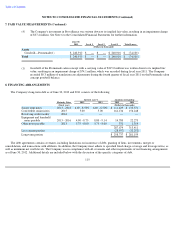

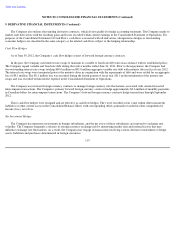

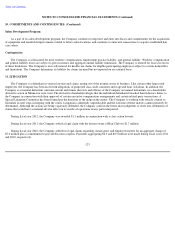

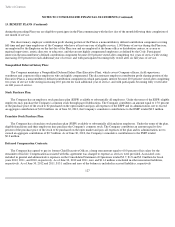

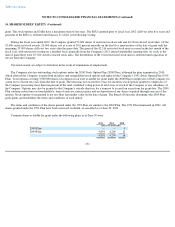

The (benefit) provision for income taxes consists of:

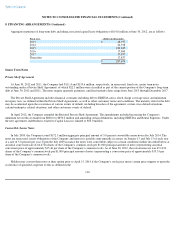

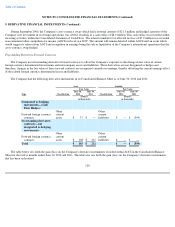

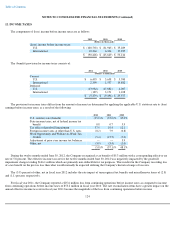

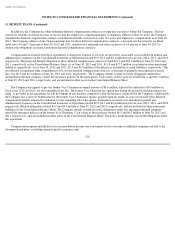

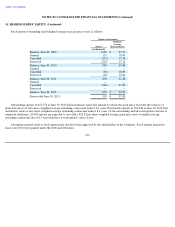

The provision for income taxes differs from the amount of income tax determined by applying the applicable U.S. statutory rate to (loss)

earnings before income taxes, as a result of the following:

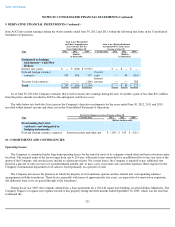

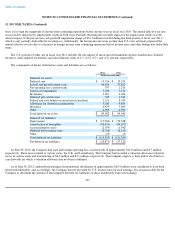

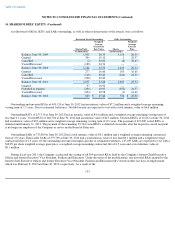

During the twelve months ended June 30, 2012, the Company recognized a tax benefit of $5.3 million with a corresponding effective tax

rate of 5.8 percent. The effective income tax rate for the twelve months ended June 30, 2012 was negatively impacted by the goodwill

impairment charges totaling $146.1 million which are primarily non-deductible for tax purposes. This resulted in the Company recording less

of a tax benefit on the pre-tax loss than what would normally be expected utilizing the Company's historical range of tax rates.

The (3.9) percent of other, net in fiscal year 2012 includes the rate impact of unrecognized tax benefits and miscellaneous items of (2.8)

and (1.1) percent, respectively.

For fiscal year 2011, the Company reported a $25.6 million loss from continuing operations before income taxes as compared to income

from continuing operations before income taxes of $53.2 million in fiscal year 2010. The rate reconciliation items have a greater impact on the

annual effective income tax rate in fiscal year 2011 because the magnitude of the loss from continuing operations before income

124

2012 2011 2010

(Dollars in thousands)

(Loss) income before income taxes:

U.S.

$

(100,792

)

$

(31,963

)

$

35,289

International

10,364

6,334

17,925

$

(90,428

)

$

(25,629

)

$

53,214

2012 2011 2010

(Dollars in thousands)

Current:

U.S.

$

6,493

$

3,658

$

5,580

International

2,399

1,557

14,882

Deferred:

U.S.

(13,984

)

(17,882

)

4,007

International

(187

)

3,171

1,108

$

(5,279

)

$

(9,496

)

$

25,577

2012 2011 2010

U.S. statutory rate (benefit)

(35.0

)%

(35.0

)%

35.0

%

State income taxes, net of federal income tax

benefit

0.8

0.7

5.9

Tax effect of goodwill impairment

37.9

10.4

12.1

Foreign income taxes at other than U.S. rates

(0.2

)

7.9

(0.8

)

Work Opportunity and Welfare-to-Work Tax

Credits

(5.4

)

(15.7

)

(7.0

)

Adjustment of prior year income tax balances

—

—

3.9

Other, net

(3.9

)

(5.4

)

(1.0

)

(5.8

)%

(37.1

)%

48.1

%