Supercuts 2012 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2012 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

14. SHAREHOLDERS' EQUITY (Continued)

In addition, 250,000 shares of authorized capital stock have been designated as Series A Junior Participating Preferred Stock (preferred

stock). None of the preferred stock has been issued.

Shareholders' Rights Plan:

The Company has a shareholders' rights plan pursuant to which one preferred share purchase right is held by shareholders for each

outstanding share of common stock. The rights become exercisable only following the acquisition by a person or group, without the prior

consent of the Board of Directors, of 15.0 percent or more of the Company's voting stock, or following the announcement of a tender offer or

exchange offer to acquire an interest of 15.0 percent or more. If the rights become exercisable, they entitle all holders, except the takeover

bidder, to purchase one one-thousandth of a share of preferred stock at an exercise price of $140, subject to adjustment, or in lieu of purchasing

the preferred stock, to purchase for the same exercise price common stock of the Company (or in certain cases common stock of an acquiring

company) having a market value of twice the exercise price of a right.

Share Repurchase Program:

In May 2000, the Company's Board of Directors (BOD) approved a stock repurchase program. Originally, the program authorized up to

$50.0 million to be expended for the repurchase of the Company's stock. The BOD elected to increase this maximum to $100.0 million in

August 2003, to $200.0 million on May 3, 2005, and to $300.0 million on April 26, 2007. The timing and amounts of any repurchases will

depend on many factors, including the market price of the common stock and overall market conditions. Historically, the repurchases to date

have been made primarily to eliminate the dilutive effect of shares issued in conjunction with acquisitions, restricted stock grants and stock

option exercises. All repurchased shares become authorized but unissued shares of the Company. This repurchase program has no stated

expiration date. As of June 30, 2012, 2011, and 2010, a total accumulated 6.8 million shares have been repurchased for $226.5 million. As of

June 30, 2012, $73.5 million remains to be spent on share repurchases under this program.

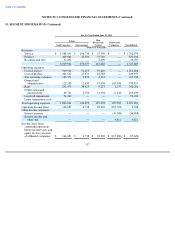

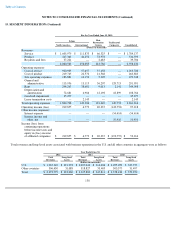

15. SEGMENT INFORMATION

As of June 30, 2012, the Company owned, franchised or held ownership interests in approximately 12,600 worldwide locations. The

Company's locations consisted of 9,340 North American salons (located in the U.S., Canada and Puerto Rico), 398 international salons, 98 hair

restoration centers, and 2,811 locations in which the Company maintains a non-controlling ownership interest through its investments in

affiliates.

The Company operates its North American salon operations through five primary concepts: Regis Salons, MasterCuts, SmartStyle,

Supercuts and Promenade salons. The concepts offer similar products and services, concentrate on the mass market consumer marketplace and

have consistent distribution channels. All of the company-owned and franchise salons within the North American salon concepts are located in

high traffic, retail shopping locations that attract mass market consumers, and the individual salons display similar long-term economic

characteristics. The salons share interdependencies and a common support base.

The Company operates its International salon operations, primarily in the United Kingdom, through three primary concepts: Regis,

Supercuts, and Sassoon salons. Consistent with the North American concepts, the international concepts offer similar products and services,

concentrate on the

135