Supercuts 2012 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2012 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

9. DERIVATIVE FINANCIAL INSTRUMENTS (Continued)

During September 2006, the Company's cross-currency swap (which had a notional amount of $21.3 million and hedged a portion of the

Company's net investment in its foreign operations) was settled, resulting in a cash outlay of $8.9 million. This cash outlay was recorded within

investing activities within the Consolidated Statement of Cash Flows. The related cumulative tax-

effected net loss of $7.9 million was recorded

in accumulated other comprehensive income (AOCI) in fiscal year 2007. The amount will remain deferred within AOCI until an event which

would trigger its release from AOCI and recognition in earnings being the sale or liquidation of the Company's international operations that the

cross-currency swap hedged.

Freestanding Derivative Forward Contracts

The Company uses freestanding derivative forward contracts to offset the Company's exposure to the change in fair value of certain

foreign currency denominated investments and intercompany assets and liabilities. These derivatives are not designated as hedges and

therefore, changes in the fair value of these forward contracts are recognized currently in earnings, thereby offsetting the current earnings effect

of the related foreign currency denominated assets and liabilities.

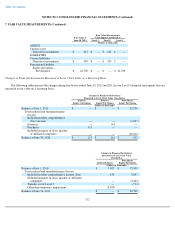

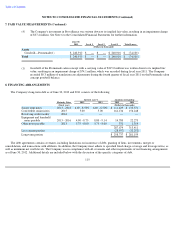

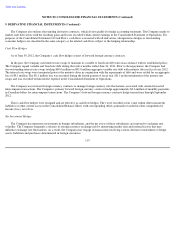

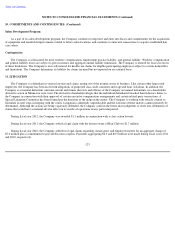

The Company had the following derivative instruments in its Consolidated Balance Sheet as of June 30, 2012 and 2011:

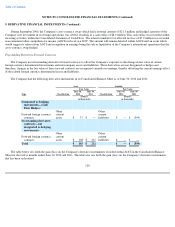

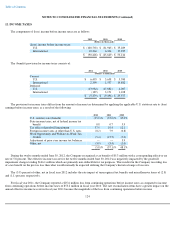

The table below sets forth the gain (loss) on the Company's derivative instruments recorded within AOCI in the Consolidated Balance

Sheet for the twelve months ended June 30, 2012 and 2011. The table also sets forth the gain (loss) on the Company's derivative instruments

that has been reclassified

120

Asset Liability

Fair Value

Fair Value

Type

Classification June 30,

2012 June 30,

2011 Classification June 30,

2012 June 30,

2011

(Dollars

in thousands)

(Dollars

in thousands)

Designated as hedging

instruments—Cash

Flow Hedges:

Forward foreign currency

contracts

Other

current

assets

$

37

$

—

Other

current

liabilities

$

—

$

(

599

)

Freestanding derivative

contracts—not

designated as hedging

instruments:

Forward foreign currency

contracts

Other

current

assets

$

108

$

212

Other

current

liabilities

$

—

$

—

Total

$

145

$

212

$

—

$

(

599

)