Supercuts 2012 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2012 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

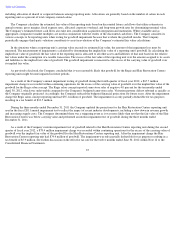

Discount rate.

A discount rate of 11.0 percent based on the weighted average cost of capital that equals the rate of return on debt

capital and equity capital weighted in proportion to the capital structure common to the industry.

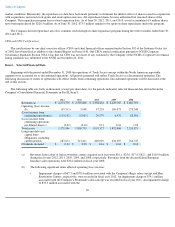

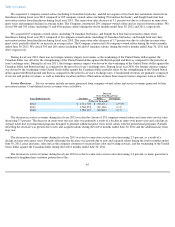

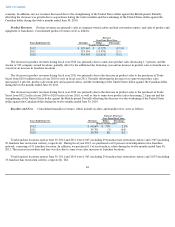

The following table summarizes the approximate impact that a change in certain critical assumptions would have on the estimated fair

value of our Promenade salon concept goodwill balance (the approximate impact of the change in the critical assumptions assumes all other

assumptions and factors remain constant):

The respective fair values of the Company's remaining reporting units exceeded fair value by greater than 20.0 percent at June 30, 2012.

While the Company has determined the estimated fair values of Promenade to be appropriate based on the historical level of revenue growth,

operating income and cash flows, it is reasonably likely that Promenade may experience additional impairment in future periods. As previously

disclosed, the Company has agreed to sell the Hair Restoration Centers reporting unit in the first half of fiscal year 2013; however, until this

reporting unit is sold it is reasonably likely there could be impairment of the Hair Restoration Centers reporting unit's goodwill in future

periods. The term "reasonably likely" refers to an occurrence that is more than remote but less than probable in the judgment of the Company.

Because some of the inherent assumptions and estimates used in determining the fair value of the reportable segment are outside the control of

management, changes in these underlying assumptions can adversely impact fair value. Potential impairment of a portion or all of the carrying

value of goodwill for the Promenade salon concept and Hair Restoration Centers reporting units is dependent on many factors and cannot be

predicted with certainty.

As of June 30, 2012, the Company's estimated fair value, as determined by the sum of our reporting units' fair value reconciled to within a

reasonable range of our market capitalization which included an assumed control premium.

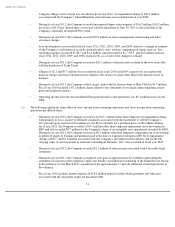

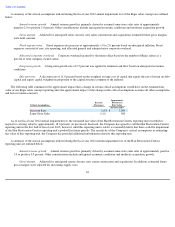

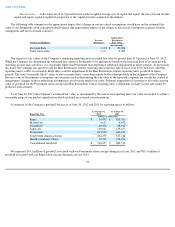

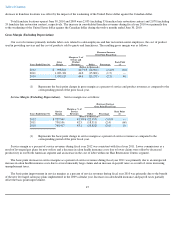

A summary of the Company's goodwill balance as of June 30, 2012 and 2011 by reporting unit is as follows:

We impaired $74.1 million of goodwill associated with our Promenade salon concept during fiscal year 2011 and $35.3 million of

goodwill associated with our Regis salon concept during fiscal year 2010.

38

Critical Assumptions Increase

(Decrease)

Approximate

Decrease in

Fair Value

(In thousands)

Discount Rate

1.0

%

$

29,000

Same

-

Store Sales

(1.0

)

2,000

Reporting Unit As of June 30,

2012 As of June 30,

2011

(Dollars in thousands)

Regis

$

34,992

$

103,761

MasterCuts

4,652

4,652

SmartStyle

49,476

48,916

Supercuts

129,621

129,477

Promenade

243,538

240,910

Total North America Salons

462,279

527,716

Hair Restoration Centers

74,376

152,796

Consolidated Goodwill

$

536,655

$

680,512