Supercuts 2012 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2012 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

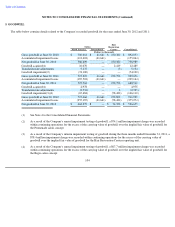

7. FAIR VALUE MEASUREMENTS (Continued)

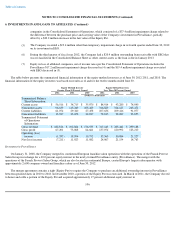

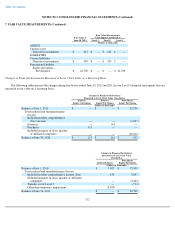

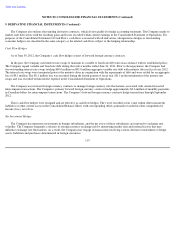

Changes in Financial Instruments Measured at Level 3 Fair Value on a Recurring Basis

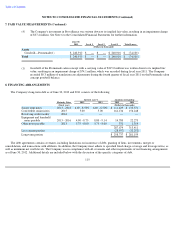

The following tables present the changes during the twelve ended June 30, 2012 and 2011 in our Level 3 financial instruments that are

measured at fair value on a recurring basis.

112

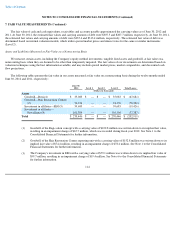

Fair Value Measurements

Using Inputs Considered as

Fair Value at

June 30, 2011

Level 1 Level 2 Level 3

(Dollars in thousands)

ASSETS

Current assets

Derivative instruments

$

212

$

—

$

212

$

—

LIABILITIES

Current liabilities

Derivative instruments

$

599

$

—

$

599

$

—

Noncurrent liabilities

Equity put option—

Provalliance

$

22,700

$

—

$

—

$

22,700

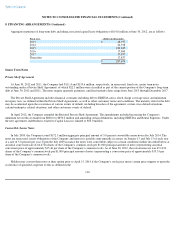

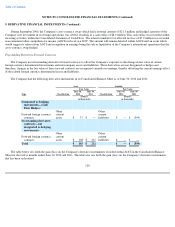

Changes in Financial Instruments

Measured at Level 3 Fair Value Classified as

Roosters

Equity Call Option Roosters

Equity Put Option Provalliance

Equity Put Option

(Dollars in thousands)

Balance at July 1, 2011

$

—

$

—

$

22,700

Total realized and unrealized gains

(losses):

Included in other comprehensive

(loss) income

—

—

(

1,845

)

Issuances

—

161

—

Purchases

117

—

—

Included in equity in (loss) income

of affiliated companies

—

—

(

20,222

)

Balance at June 30, 2012

$

117

$

161

$

633

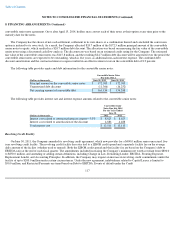

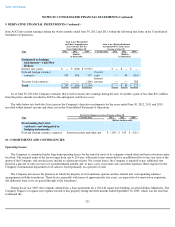

Changes in Financial Instruments

Measured at Level 3 Fair Value

Classified as

Preferred Shares Provalliance

Equity Put Option

(Dollars in thousands)

Balance at July 1, 2010

$

3,502

$

22,009

Total realized and unrealized gains (losses):

Included in other comprehensive income (loss)

433

3,847

Included in equity in (loss) income of affiliated

companies

—

(

2,442

)

Transfer out of Level 3

—

(

714

)

Other than temporary impairment

(3,935

)

—

Balance at June 30, 2011

$

—

$

22,700