Supercuts 2012 Annual Report Download - page 144

Download and view the complete annual report

Please find page 144 of the 2012 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

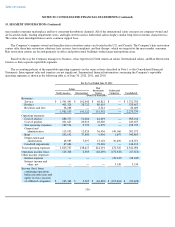

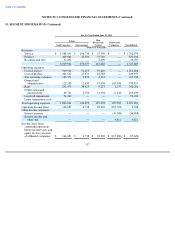

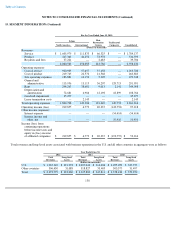

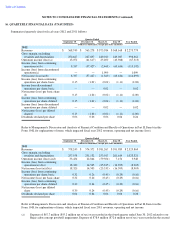

16. QUARTERLY FINANCIAL DATA (UNAUDITED) (Continued)

17. SUBSEQUENT EVENTS

On July 11, 2012, the Company announced that Mr. Daniel J. Hanrahan was appointed President and Chief Executive Officer of the

Company, effective August 6, 2012. He was also appointed to the Board of Directors, effective August 6, 2012.

On July 13, 2012, the Company entered into a definitive agreement to sell Hair Club to Aderans, Co., Ltd. for cash of $163.5 million

excluding closing adjustments and transaction fees. Subsequent to fiscal year 2012, the net assets of Hair Club to be sold met the accounting

criteria to be classified as held for sale and will be aggregated and reported in accordance with authoritative guidance in the Company's fiscal

year 2013 first quarter Form 10

-Q. The Company is currently anticipating recognizing a gain upon closing of the deal. The transaction is

expected to close in the first or second fiscal quarter of 2013, and is subject to customary closing conditions.

On July 17, 2012, Mr. Daniel G. Beltzman was appointed to the Board of Directors of the Company, effective August 1, 2012.

140

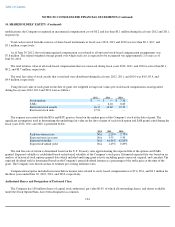

(b) Expense of $17.2 million was recorded during fiscal year 2012 related to the impairment of our investment in

Provalliance as a result of the Company entering into a Share Purchase Agreement to sell the Company's 46.7 percent

equity interest in Provalliance for a purchase price of €80 million. Expense of $19.4 million was recorded during fiscal

year 2012 related to the impairment of our investment in EEG.

(c) During the third quarter ended March 31, 2012, the Company recorded a $1.1 million tax benefit in discontinued

operations related to the release of tax reserves associated with the disposition of the Trade Secret salon concept.

(d)

Operating income and net income decreased $31.2 million ($19.2 million net of tax) as a result of a valuation reserve on a

note receivable with the purchase of Trade Secret that was recorded in the third quarter ($9.0 million) and fourth quarter

($22.2 million) of fiscal year 2011.

(e) Income (loss) from continuing operations and net income decreased as a result of $9.2 million that was recorded in the

third quarter ($8.7 million) and in the fourth quarter ($0.5 million) as a result of an other than temporary impairment on

an investment in preferred shares of Yamano and a premium paid at the time of an initial investment in MY Style.

(f)

Total is a recalculation; line items calculated individually may not sum to total.