Supercuts 2012 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2012 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

14. SHAREHOLDERS' EQUITY (Continued)

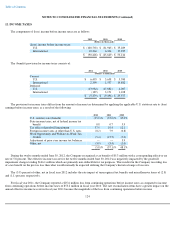

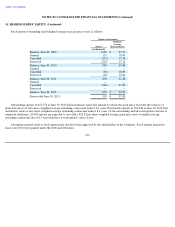

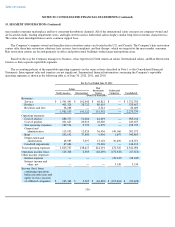

The following table sets forth the awards, which are excluded from the various earnings per share calculations:

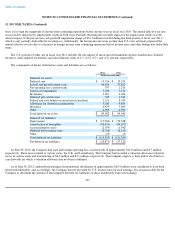

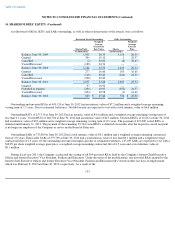

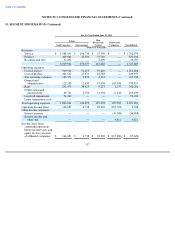

The following table sets forth a reconciliation of the net (loss) income from continuing operations available to common shareholders and

the net (loss) income from continuing operations for diluted earnings per share under the if-converted method:

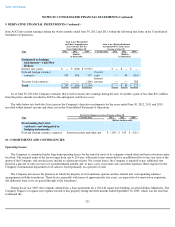

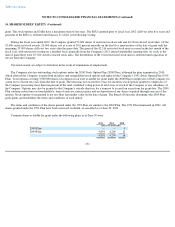

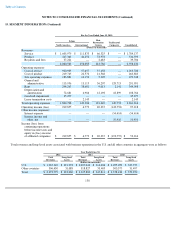

Stock-based Compensation Award Plans:

In May of 2004, the Company's Board of Directors approved the 2004 Long Term Incentive Plan (2004 Plan). The 2004 Plan received

shareholder approval at the annual shareholders' meeting held on October 28, 2004. The 2004 Plan provides for the granting of stock options,

equity-based stock appreciation rights (SARs) and restricted stock, as well as cash-based performance grants, to employees and directors of the

Company. On March 8, 2007, the Company's Board of Directors approved an amendment to the 2004 Plan to permit the granting and issuance

of restricted stock units (RSUs). On October 28, 2010, the shareholders of Regis Corporation approved an amendment to the 2004 Plan to

increase the maximum number of shares of the Company's common stock authorized for issuance pursuant to grants and awards from

2,500,000 to 6,750,000. The 2004 Plan expires on May 26, 2014. Stock options, SARs and restricted stock granted prior to fiscal year 2012

under the 2004 Plan generally vest at a rate of 20.0 percent annually on each of the first five anniversaries of the date of

130

2012 2011 2010

(Shares in thousands)

Basic earnings per share:

RSAs(1)

403

862

931

RSUs(1)

17

215

215

420

1,077

1,146

Diluted earnings per share:

Stock options(2)

789

890

960

SARs(2)

957

1,084

1,110

RSAs(2)

242

580

677

Shares issuable upon conversion of debt(2)

11,209

11,163

—

13,197

13,717

2,747

(1) Shares were not vested

(2)

Share were anti-dilutive

2012 2011 2010

(Dollars in thousands)

Net (loss) income from continuing

operations available to common

shareholders

$

(115,192

)

$

(8,905

)

$

39,579

Effect of dilutive securities:

Interest on convertible debt

—

—

7,520

Net (loss) income from continuing

operations for diluted earnings per share

$

(115,192

)

$

(8,905

)

$

47,099