Supercuts 2012 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2012 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

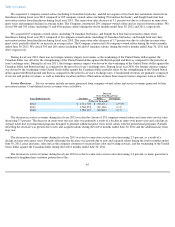

• The Company recorded incremental depreciation expense of $16.2 million ($10.2 million net of tax or $0.18 per diluted share)

associated with the adjustment to the useful life of the Company's POS system.

• During fiscal year 2012, the Company reduced the home office workforce by approximately 120 employees. The Company

recorded $9.8 million in senior management restructuring and other severance charges. In addition the Company recorded

$2.8 million in other restructuring charges associated with one-time costs with implementing the Company's new strategy.

• The Company recorded $1.8 million in deferred compensation expense associated with amending the deferred compensation

contracts such that the benefits are based on years of service and employees' compensation as of June 30, 2012.

• The Company recorded charges of $4.9 million associated with professional fees incurred in connection with the contested

proxy and the exploration of alternatives for non-core assets.

• The Company recorded a $1.1 million favorable legal settlement during fiscal year 2012.

• During fiscal year 2012, the Company recorded a $1.1 million tax benefit in discontinued operations related to the release of tax

reserves associated with the disposition of the Trade Secret salon concept.

• The annual effective income tax rate of 5.8 percent was negatively impacted by the goodwill impairment charges which are

partially non-deductible for tax purposes. This resulted in the Company recording less of a tax benefit on the pre-tax loss than

what would normally be expected utilizing the Company's historical range of tax rates.

RESULTS OF OPERATIONS

The following discussion of results of operations will reflect results from continuing operations. Discontinued operations will be discussed

at the end of this section.

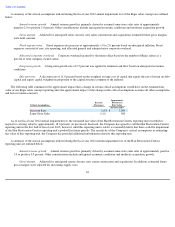

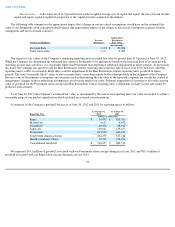

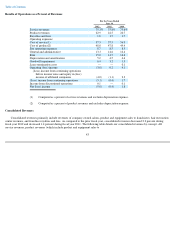

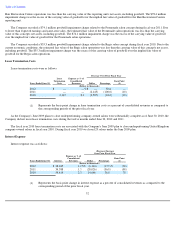

Consolidated Results of Operations

The following table sets forth, for the periods indicated, certain information derived from our Consolidated Statement of Operations in

Item 8, expressed as a percent of revenues. The percentages are computed as a percent of total revenues, except as noted.

42