Supercuts 2012 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2012 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Other Notes Payable

The Company had $0.3 and $1.3 million in unsecured outstanding notes at June 30, 2012 and 2011, respectively, related to debt assumed

in acquisitions.

Acquisitions

Acquisitions are discussed throughout Management's Discussion and Analysis in this Item 7, as well as in Note 4 to the Consolidated

Financial Statements in Part II, Item 8 of this Form 10-K. The acquisitions were funded primarily from operating cash flow, debt and the

issuance of common stock.

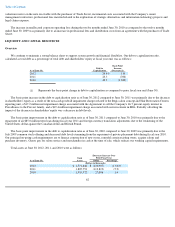

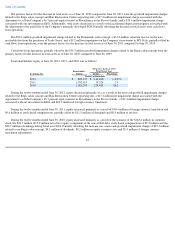

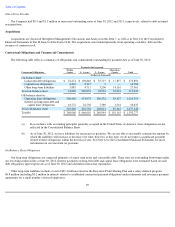

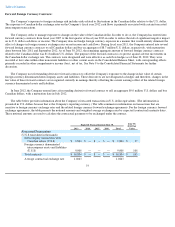

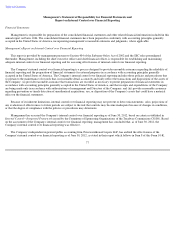

Contractual Obligations and Commercial Commitments

The following table reflects a summary of obligations and commitments outstanding by payment date as of June 30, 2012:

On-Balance Sheet Obligations

Our long-term obligations are composed primarily of senior term notes and convertible debt. There were no outstanding borrowings under

our revolving credit facility at June 30, 2012. Interest payments on long-term debt and capital lease obligations were estimated based on each

debt obligation's agreed upon rate as of June 30, 2012 and scheduled contractual repayments.

Other long-term liabilities include a total of $21.2 million related to the Executive Profit Sharing Plan and a salary deferral program,

$6.8 million (including $0.2 million in interest) related to established contractual payment obligations under retirement and severance payment

agreements for a small number of retired employees.

69

Payments due by period

Contractual Obligations Within

1 years 1 - 3 years 3 - 5 years More than

5 years Total

(Dollars in thousands)

On

-

balance sheet:

Long

-

term debt obligations

$

22,474

$

196,848

$

35,715

$

17,857

$

272,894

Capital lease obligations

6,463

8,315

2

—

14,780

Other long

-

term liabilities

5,883

4,711

3,206

14,161

27,961

Total on

-

balance sheet

34,820

209,874

38,923

32,018

315,635

Off

-

balance sheet(a):

Operating lease obligations

306,468

433,978

200,432

85,627

1,026,505

Interest on long-term debt and

capital lease obligations

18,772

22,758

7,589

1,518

50,637

Total off

-

balance sheet

325,240

456,736

208,021

87,145

1,077,142

Total(b)

$

360,060

$

666,610

$

246,944

$

119,163

$

1,392,777

(a) In accordance with accounting principles generally accepted in the United States of America, these obligations are not

reflected in the Consolidated Balance Sheet.

(b) As of June 30, 2012, we have liabilities for uncertain tax positions. We are not able to reasonably estimate the amount by

which the liabilities will increase or decrease over time; however, at this time, we do not expect a significant payment

related to these obligations within the next fiscal year. See Note 12 to the Consolidated Financial Statements for more

information on our uncertain tax positions.