Supercuts 2012 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2012 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

1. BUSINESS DESCRIPTION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

calculated liability amount is reviewed for reasonableness based on reserve adequacy ranges for historical periods by testing prior reserve

levels against actual expenses to date.

Although the Company does not expect the amounts ultimately paid to differ significantly from the estimates, self-insurance accruals

could be affected if future claims experience differs significantly from the historical trends and actuarial assumptions. For fiscal year 2012, the

Company recorded an increase in expense from changes in estimates related to prior year open policy periods related to continuing operations

of $0.7 million. For fiscal year 2011, the Company recorded an increase in expense from changes in estimates related to prior year open policy

periods related to continuing operations of $1.4 million. For fiscal year 2010, the Company recorded a decrease in expense from changes in

estimates related to prior year open policy periods related to continuing operations of $1.7 million. A 10.0 percent change in the self-insurance

reserve would affect (loss) income from continuing operations before income taxes and equity in (loss) income of affiliated companies by $4.8,

$4.6, and $4.5 million for the three years ended June 30, 2012, 2011 and 2010, respectively. The Company updates loss projections twice each

year and adjusts its recorded liability to reflect the current projections. The updated loss projections consider new claims and developments

associated with existing claims for each open policy period. As certain claims can take years to settle, the Company has multiple policy periods

open at any point in time.

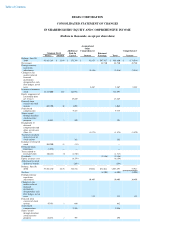

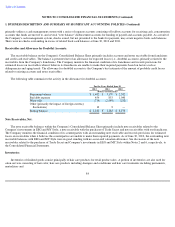

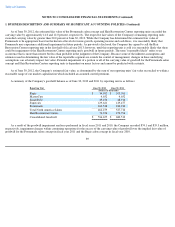

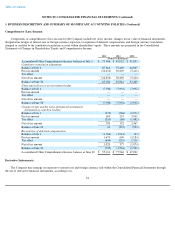

As the workers' compensation accrual is the majority of the self-insurance accrual, below is a rollforward of the activity within the

Company's workers' compensation self-insurance accrual:

As of June 30, 2012, the Company had $15.5 and $32.5 million recorded in current liabilities and noncurrent liabilities, respectively,

related to the Company's self-insurance accruals, which includes the workers' compensation self-insurance accrual. As of June 30, 2011, the

Company had $14.7 and $30.9 million recorded in current liabilities and noncurrent liabilities, respectively, related to the Company's self-

insurance accruals, which includes the workers' compensation self-insurance accrual.

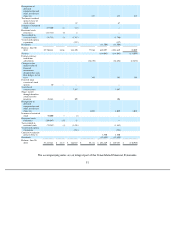

Goodwill:

Goodwill is tested for impairment annually or at the time of a triggering event. In evaluating whether goodwill is impaired, the Company

compares the carrying value of each reporting unit, including goodwill, to the estimated fair value of the reporting unit. The carrying value of

each reporting unit is based on the assets and liabilities associated with the operations of the reporting unit, including allocation of shared or

corporate balances among reporting units. Allocations are generally based on the number of salons in each reporting unit as a percent of total

company-owned salons.

87

For the Years Ended June 30,

2012 2011 2010

(Dollars in thousands)

Beginning balance

$

32,994

$

30,082

$

31,505

Provision for incurred losses

14,133

13,993

14,739

Prior year actuarial loss development

1,221

2,231

35

Claim payments

(14,140

)

(12,584

)

(14,867

)

Other, net

415

(728

)

(1,330

)

Ending balance

$

34,623

$

32,994

$

30,082