Supercuts 2012 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2012 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

contractually narrow or limited purposes at June 30, 2012. As such, we are not materially exposed to any financing, liquidity, market or credit

risk that could arise if we had engaged in such relationships.

Sources of Liquidity

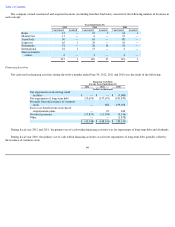

Funds generated by operating activities, available cash and cash equivalents, and our revolving credit facility are our most significant

sources of liquidity. We believe our sources of liquidity will be sufficient to sustain operations and to finance anticipated growth opportunities

and strategic initiatives. We also anticipate access to long-

term financing. However, in the event our liquidity is insufficient and we are not able

to access long-term financing, we may be required to limit our growth opportunities. There can be no assurance that we will continue to

generate cash flows at or above current levels.

In the first half of fiscal year 2013 the Company is expecting to receive approximately $260 million upon completion of the sale of

Provalliance and Hair Club. We are currently evaluating the Company's capital structure and the future use of these proceeds. As of June 30,

2012, cash and cash equivalents were $47.9, $32.8 and $31.2 million within the United States, Canada, and Europe, respectively.

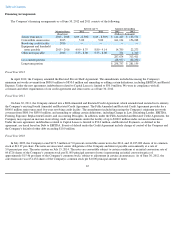

We have a $400.0 million five-year senior unsecured revolving credit facility with a syndicate of banks that expires in June 2016. As of

June 30, 2012, the Company had no outstanding borrowings under the facility. Additionally, the Company had outstanding standby letters of

credit under the facility of $26.1 million at June 30, 2012, primarily related to its self-insurance program. Unused available credit under the

facility at June 30, 2012 was $373.9 million.

Our ability to access our revolving credit facility is subject to our compliance with the terms and conditions of such facility, including

minimum net worth and other covenants and requirements. At June 30, 2012, we were in compliance with all covenants and other requirements

of our credit agreement and senior notes.

Financing

Financing activities are discussed under "Liquidity and Capital Resources" in this Item 7 and in Note 8 to the Consolidated Financial

Statements in Part II, Item 8. Derivative activities are discussed in Note 9 to the Consolidated Financial Statements in Part II, Item 8 and

Part II, Item 7A, "Quantitative and Qualitative Disclosures about Market Risk."

Management believes that cash generated from operations and amounts available under existing debt facilities will be sufficient to fund its

anticipated capital expenditures, acquisitions and required debt repayments for the foreseeable future. As of June 30, 2012, we have available

an unused committed line of credit amount of $373.9 million under our existing revolving credit facility.

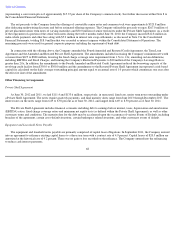

Dividends

We paid dividends of $0.24 per share during fiscal year 2012, $0.20 per share during fiscal year 2011, and $0.16 per share during fiscal

year 2010. On August 22, 2012, the Board of Directors of the Company declared a $0.06 per share quarterly dividend payable September 19,

2012 to shareholders of record on September 5, 2012.

Share Repurchase Program

In May 2000, the Company's Board of Directors (BOD) approved a stock repurchase program. Originally, the program authorized up to

$50.0 million to be expended for the repurchase of the Company's stock. The BOD elected to increase this maximum to $100.0 million in

August 2003, to $200.0 million on May 3, 2005, and to $300.0 million on April 26, 2007. The timing and amounts of any repurchases will

depend on many factors, including the market price of the common stock and overall market conditions. Historically, the repurchases to date

have been made primarily to eliminate the

71