Supercuts 2012 Annual Report Download - page 159

Download and view the complete annual report

Please find page 159 of the 2012 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

(d) up to $5,000,000 in the aggregate for such period of (i) non-recurring cash charges in connection with restructurings and

(ii) external professional fees and diligence expenses relating to Acquisitions (whether or not consummated); plus

(e) if the Company or any Subsidiary acquires a Person (an “ Acquired Person ”) in an acquisition during such period, all of

the Acquired Person’s EBITDA (calculated for such Person as set forth above without giving effect to clause (c)) for the four fiscal

quarters then ended; minus

(f) if the Company or any Subsidiary sells all or substantially all of the stock or assets of any Subsidiary during such period,

the EBITDA of such Subsidiary (calculated for such Person as set forth above without giving effect to clause (c)) for the four fiscal

quarters then ended; plus

(g) all non-cash losses and expenses and non-cash impairment charges (including non-cash compensation expense and non-

cash impairment of goodwill and other intangibles or arising in connection with any Joint Venture) to the extent deducted in

determining such net income; minus

(h) all cash payments made during such period that arise out of non-cash losses or expenses and impairment charges taken in

any previous period.

“Margin Stock” means “margin stock” as defined in paragraph 8I hereof.

“Rental Expense” means, for any period, the sum of (a) all store rental payments (excluding lease termination payments),

(b) all common area maintenance payments and (c) all real estate taxes paid by the Company and its Subsidiaries, in each case, with

respect to non-franchised store location (and not, for avoidance of doubt, with respect to office or warehouse locations).

1.12. Paragraph 10C of the Shelf Agreement is amended by adding the following sentence to the end thereof:

“Notwithstanding any provision of this Agreement to the contrary, for purposes of this Agreement (other than covenants to deliver

financial statements), the determination of whether a lease constitutes a capital lease or an operating lease and whether obligations

arising under a lease are required to be capitalized on the balance sheet of the lessee thereunder and/or recognized as interest expense

in the lessee’s financial statements shall be determined under generally accepted accounting principles in the United States as of June

30, 2011, notwithstanding any modifications or interpretive changes thereto that may occur thereafter.”

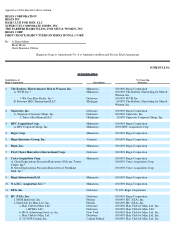

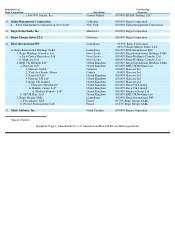

1.13. Schedule 8A — Subsidiaries to the Shelf Agreement is deleted and Schedule 8A — Subsidiaries attached to this letter is

substituted in lieu thereof.

1.14. Schedule 8G — Agreements Restricting Debt to the Shelf Agreement is deleted and Schedule 8G — Agreements Restricting

Debt attached to this letter is substituted in lieu thereof.

5