Starwood 2015 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2015 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

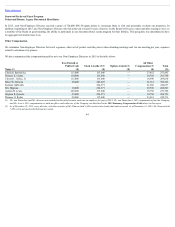

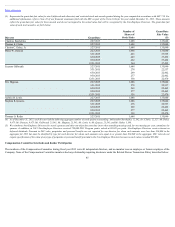

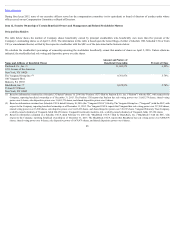

(1) Audit fees include the fees paid for the annual audit, the review of quarterly financial statements, assistance with and review of documents filed with the SEC and the audit

of the Company’s internal controls over financial reporting, as well as audits related to financial reports required as part of regulatory and statutory filings.

(2) Audit-related fees include fees for due diligence services related to the Company’s strategic alternatives review, audit of Vistana’s stand-alone financial statements and

other attest services not required by statute or regulation.

(3) Tax fees include domestic and foreign tax compliance and consultations regarding tax matters, including matters related to the Company’s strategic alternatives review.

The Company has adopted a policy which requires the Audit Committee of the Board of Directors to approve the hiring of any current or former employee (within

the last five years) of the Company’s independent registered public accounting firm into any position (i) as a manager or higher, (ii) in its accounting or tax

departments, (iii) where the hire would have direct involvement in providing information for use in its financial reporting systems, or, (iv) where the hire would be

in a policy-setting position. When undertaking its review, the Audit Committee considers applicable laws, regulations and related commentary regarding the

definition of “independence” for independent registered public accounting firms.

Pre-Approval of Services

The Audit Committee pre-approves all services, including both audit and non-audit services, provided by the Company’s independent registered public accounting

firm. The independent registered public accounting firm submits an audit services fee proposal, which also must be approved by the Audit Committee before the

audit commences. The Audit Committee may delegate authority to one of its members to pre-approve all audit/non-audit services by the independent registered

public accounting firm, as long as these approvals are presented to the full Audit Committee at its next regularly scheduled meeting.

Management submits to the Audit Committee all non-audit services that it recommends the independent registered public accounting firm be engaged to provide

and an estimate of the fees to be paid for each. Management and the independent registered public accounting firm must each confirm to the Audit Committee that

the performance of the non-audit services on the list would not compromise the independence of the registered public accounting firm and would be permissible

under all applicable legal requirements. The Audit Committee must approve both the list of non-audit services and the budget for each such service before

commencement of the work. Management and the independent registered public accounting firm report to the Audit Committee at each of its regular meetings as to

the non-audit services actually provided by the independent registered public accounting firm and the approximate fees incurred by the Company for those services.

All audit and permissible non-audit services provided by Ernst & Young LLP to the Company for the fiscal years ended December 31, 2015 and 2014 were pre-

approved by the Audit Committee or our Board.

51