Starwood 2015 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2015 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

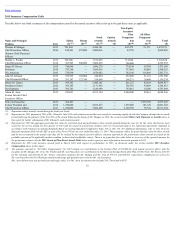

below), on December 30, 2015, the Compensation Committee granted Mr. Aron 70,019 fully vested shares of Company common stock in full satisfaction of the

obligation to deliver restricted stock under the employment agreement.

Payouts of 2013 Performance Share Grants. Each of Messrs. Rivera, Turner and van Paasschen earned performance shares originally granted on February 28,

2013 (or the 2013 Performance Shares), which were paid to such named executive officers in February 2016. The number of performance shares each such named

executive officer earned was based on the relative TSR performance of the Company over the three-year performance period ended on December 31, 2015. The

peer group against which TSR was compared was comprised of the same companies as the peer group for 2015 performance share awards, except that Hilton

Worldwide Holdings Inc. was not included because it had not yet completed its initial public offering at the time the peer group was established for the 2013

Performance Shares. The 2013 Performance Shares were subject to the same payout matrix that applies to the 2015 performance share grants, with potential

payouts ranging from 0% (for performance in the bottom quartile of the peer group) to 200% (for performance in the 80 th percentile of the peer group or above).

After the end of the performance period, the Compensation Committee determined that the Company’s 2013-2015 TSR was 41.64%, ranking the Company at the

25.48 th percentile with respect to relative TSR against the peer group. As a result, such named executive officers earned a payout of 2.39% of the target number of

performance shares (238 shares for Mr. Rivera, 556 shares for Mr. Turner and 954 shares for Mr. van Paasschen). The shares received by Mr. van Paasschen reflect

two-thirds of the number of shares that he would have earned had he remained employed by the Company until the date of payment, pursuant to the terms of the

van Paasschen Separation Agreement (as defined below). The 2013 Performance Shares were settled in shares of the Company’s common stock. In addition, each

such named executive officer received a cash dividend equivalent payment equal to the aggregate amount of dividends per share declared and paid to the

Company’s stockholders on our common stock from the beginning of the performance period through the payout of the 2013 Performance Shares, multiplied by the

number of performance shares actually earned by such named executive officer.

Other Cash Payments or Awards

Separation Arrangement with Mr. van Paasschen. Pursuant to Mr. van Paasschen’s Separation Agreement and General Release (as further described below),

following Mr. van Paasschen’s termination of employment on February 28, 2015, Mr. van Paasschen continued to serve the Company as a consultant through

May 31, 2015. During that period, Mr. van Paasschen was paid a monthly consulting fee equal to $104,167, and received reimbursements for certain business

expenses. In addition, Mr. van Paasschen was entitled to certain severance compensation and benefits, as further described below under the section titled Certain

One Time Payments Upon Termination of Employment .

Separation Arrangement with Mr. Aron . Pursuant to Mr. Aron’s Separation Agreement (as further described below), following Mr. Aron’s termination of

employment on December 30, 2015, Mr. Aron received certain severance compensation and benefits, as further described below under the section titled Certain

One Time Payments Upon Termination of Employment .

Retention Award for Mr. Schnaid . During 2015, the Compensation Committee approved a retention bonus for Mr. Schnaid equal to 50% of his base salary. In

December 2015, pursuant to Mr. Schnaid’s employment arrangement letter (which is further described below), the Company and Mr. Schnaid agreed that his

retention bonus would be fixed at $200,000. The retention bonus will become payable after a “change in control” of the Company (as defined in Mr. Schnaid’s

retention letter), subject to Mr. Schnaid’s continued employment through such date (or, if the Company determines that it will not pursue a “change in control,” on

September 30, 2016), or upon Mr. Schnaid’s termination of employment without “cause” or resignation for “good reason” (each as defined in Mr. Schnaid’s

retention letter). For purposes of Mr. Schnaid’s retention letter, “cause” generally means Mr. Schnaid’s: (1) material breach of, or failure to perform his duties,

responsibilities or obligations or material breach of any of our policies or practices; (2) failure or refusal to follow any lawful order or direction by us; (3) act

22