Starwood 2015 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2015 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

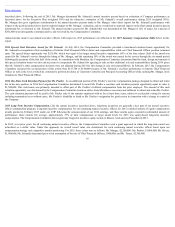

Mr. Turner’s key accomplishments for the 2015 performance year:

• Exceeded Company objectives for new hotels by signing a record number of 220 incremental management and franchise deals (representing

approximately 45,800 rooms), while achieving record contract value for SG&A expenses;

• Exceeded Company objectives for renewals and change of ownership deals, signing 101 non-incremental hotel management and franchise deals

(representing approximately 29,600 rooms);

• Opened a record number of new hotels, adding 105 hotels (representing approximately 22,500 rooms) to the Company’s footprint, the result of prior

years’ deal signings; and

• Exceeded asset disposition targets, generating over $820 million in gross proceeds from the sale of wholly owned hotels and other property ownership

interests, and positioned certain of the Company’s owned hotels for 2016 strategic disposition.

As discussed above, certain business events during 2015 prompted our named executive officers to focus on priorities significantly different from those listed

above. To that end, while the individual performance achievements described above were factors in determining final annual incentive award payouts for the

continuing named executive officers for 2015, they were only a part of the overall consideration with respect to the individual performance portion of the annual

incentives.

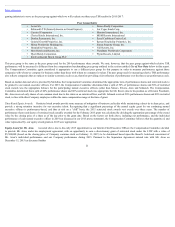

In light of the Compensation Committee’s assessments of the continuing named executive officers’ overall performance for 2015 (other than Mr. Schnaid), the

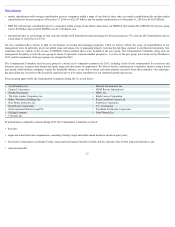

Compensation Committee awarded them the following payouts as a percentage of target for the individual performance portion of their annual incentives:

Mr. Mangas, 175% of target; Ms. Poulter, 100% of target; Mr. Rivera, 105% of target; and Mr. Turner, 120% of target. As a result, these continuing named

executive officers and Mr. Aron received the following total annual incentives, expressed in dollars and as a percentage of overall annual incentive target:

Mr. Mangas, $847,875, representing 121% of his overall annual incentive target; Ms. Poulter, $714,000, representing 102% of her overall annual incentive target;

Mr. Rivera, $774,248, representing 103% of his overall annual incentive target; Mr. Turner, $821,227, representing 107% of his overall annual incentive target; and

Mr. Aron, $2,040,000, representing 102% of his overall annual incentive target. In light of Mr. van Paasschen’s separation arrangement and our financial

performance for 2015 under the Annual Incentive Plan, the Compensation Committee provided him with a cash severance payment equal in value to one-sixth of

what the Compensation Committee determined he would have earned as his 2015 incentive under the Annual Incentive Plan had he remained employed for the

entirety of 2015 based on actual performance results ($425,000).

2015 Annual Bonus Compensation for Mr. Schnaid . Mr. Schnaid received his annual cash incentive award opportunity for 2015 under the Annual Incentive Plan.

Mr. Schnaid’s 2015 target incentive opportunity was established at 65% of his base salary (consistent with his award in prior years), and his opportunity ranged

from 0% to 200% of this target amount. This incentive opportunity level was set at the target annual incentive level established for other Company employees

within the same salary range (or band) as Mr. Schnaid. This level is checked by the Company for general purposes against market every one to three years by using

the Towers Watson survey information for companies with revenues similar to us (as discussed above). This evaluation for annual incentive purposes was last

conducted in 2014 with respect to the range as a whole, rather than specific job titles or responsibilities. For this evaluation purpose, no peer group was used, as it

was the compensation data produced by the survey information among companies with revenue in excess of $5 billion included in a general industry survey

provided by Towers Watson, rather than the identity of the individual companies participating in the survey, that was the most significant factor under this general

review.

At the beginning of 2015, the Principal Accounting Officer goals under the Executive Plan were identified as general (rather than specific) guidelines for

Mr. Schnaid’s performance during 2015. In addition, Mr. Schnaid was generally aware of both the adjusted EPS and adjusted EBITDA goals established under the

Executive Plan as

18