Starwood 2015 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2015 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ownership guidelines, incentive recouping, anti-hedging and anti-pledging policies, and board and committee assessment. The Corporate Governance and

Nominating Committee is responsible for overseeing and reviewing the Guidelines and for reporting and recommending to the Board any changes to the

Guidelines.

To further promote transparency and ensure accurate and adequate disclosure, we have established a Disclosure Committee comprised of certain senior executives

to design, establish and maintain our internal controls and other procedures with respect to the preparation of periodic reports required to be filed with the SEC,

earnings releases and other written information that we decide to disclose to the investment community. The Disclosure Committee evaluates the effectiveness of

our disclosure controls and procedures and maintains written records of its meetings.

The Board also has certain policies relating to retirement and a change in a director’s principal occupation. The Guidelines provide that directors who are not

employees of the Company or any of its subsidiaries may not stand for re-election after reaching the age of 72 and that directors who are employees of the

Company must retire from the Board upon retirement from the Company. The Guidelines provide that in the event a director changes his or her principal

occupation (including through retirement), such director should voluntarily tender his or her resignation to the Board. The Corporate Governance and Nominating

Committee will then make a recommendation to the Board as to whether the Board should accept or reject such resignation.

We indemnify our directors and officers to the fullest extent permitted by law so that they will be free from undue concern about personal liability in connection

with their service to the Company. Indemnification is required pursuant to our Charter and we have entered into agreements with our directors and executive

officers undertaking a contractual obligation to provide the same.

Communications with the Board

We have adopted a policy which permits stockholders and other interested parties to contact the Board. If you are a stockholder or interested party and would like

to contact the Board, you may send a letter to the Board of Directors, c/o the Corporate Secretary of the Company, One StarPoint, Stamford, Connecticut 06902 or

contact us online at www.hotethics.com. It is important that you identify yourself as a stockholder or an interested party in the correspondence. If the

correspondence contains complaints about our Company’s accounting, internal or auditing matters, the Corporate Secretary will advise a member of the Audit

Committee. If the correspondence concerns other matters or is directed to the non-employee directors, the Corporate Secretary will forward the correspondence to

the director to whom it is addressed or otherwise as would be appropriate under the circumstances, attempt to handle the inquiry directly (for example where it is a

request for information or a stock-related matter), or not forward the communication altogether if it is primarily commercial in nature or relates to an improper or

irrelevant topic. At each regularly scheduled Board meeting, the Corporate Secretary or his designee will present a summary of all such communications received

since the last meeting that were not forwarded and shall make those communications available to the directors upon request. This policy is also posted on our

website at www.starwoodhotels.com/corporate/about/investor/ governance.html.

Item 14. Principal Accounting Fees and Services .

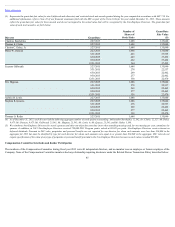

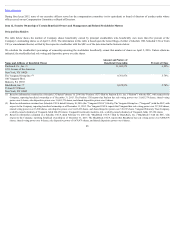

The aggregate amounts billed to the Company for the fiscal years ended December 31, 2015 and 2014 by the Company’s principal accounting firm, Ernst & Young

LLP, are as follows (in millions):

2015 2014

Audit Fees (1) $ 7.9 $7.7

Audit-Related Fees (2) $ 8.1 $0.9

Tax Fees (3) $ 1.9 $1.0

All Other Fees $ — $ —

TOTAL $17.9 $9.6

50