Starwood 2015 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2015 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

followed the Compensation Committee’s first regularly scheduled meeting that occurred after the release of our earnings for 2014. The timing of this meeting was

determined based on factors unrelated to the pricing of equity grants. The Compensation Committee (or its delegates), however, had discretion under unusual

circumstances to award grants at other times in the year, including as described above with respect to our newly hired named executive officers.

Compensation Committee Report

The Compensation Committee of the Board of Directors of Starwood Hotels & Resorts Worldwide, Inc. has reviewed and discussed the Compensation Discussion

and Analysis required by Item 402(b) of Regulation S-K with management and, based on such review and discussions, recommended to the Board of Directors that

the Compensation Discussion and Analysis be included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2015.

Compensation Committee of the Board of Directors

Thomas E. Clarke, Chairman

Clayton C. Daley, Jr.

Lizanne Galbreath

Eric Hippeau

Thomas O. Ryder

Risk Assessment

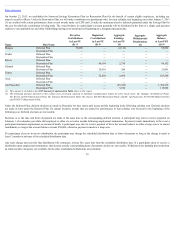

In setting compensation, our Compensation Committee also considers the risks to our stockholders, and to us as a whole, arising out of our compensation programs.

In February 2016, management, including our Chief Financial Officer, our Chief Administrative Officer, General Counsel and Secretary and our Chief Human

Resources Officer, reviewed and assessed the risk profile of our compensation programs. Meridian also participated in the process. The review considered risk-

determining characteristics of the overall structure and individual components of our Company-wide compensation program, including our base salaries, incentive

plans and equity plans. A report of the findings was provided to the Compensation Committee for its review and consideration. Following this assessment, we

believe that we have instituted policies that do not create incentives for our executive officers or other employees to take risks that are reasonably likely to have a

material adverse effect on the Company. For example:

• Balance of Compensation: Across the Company, individual elements of our compensation program include base salaries, incentive compensation, and for

certain of our employees, equity-based awards. By providing a mix of different elements of compensation that reward both short-term and long-term

performance, our compensation programs as a whole provide a balanced approach to incentivizing and retaining employees, without placing an inappropriate

emphasis on any particular form of compensation.

• Objective Formula and Pre-established Performance Measures Dictate Annual Incentives: Under the Executive Plan, payment of annual incentives to our

covered named executive officers is subject to the satisfaction of specific Company-wide annual performance targets determined under an incentive formula

established by our Compensation Committee within the first 90 days of each fiscal year. Similarly, our employees other than the named executive officers

covered by the Executive Plan that are eligible to receive an annual incentive receive such incentive subject to the satisfaction of specific Company-wide annual

performance targets determined under an incentive formula established by our Compensation Committee. These performance targets are directly and specifically

tied to one or more of the following Company-wide business criteria: EBITDA, consolidated pre-tax earnings, net revenues, net earnings, operating income,

earnings before interest and taxes, cash flow measures, return on equity, return on net assets employed or EPS for the applicable fiscal year.

29