Starwood 2015 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2015 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

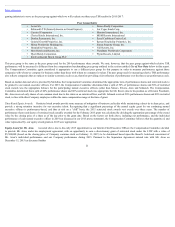

Table of Contents

described above. Following the end of 2015, Mr. Mangas determined Mr. Schnaid’s annual incentive payout based on evaluation of Company performance as

described above for the Executive Plan (weighted 50%) and his subjective evaluation of Mr. Schnaid’s overall performance during 2015 (weighted 50%).

Mr. Mangas also gave significant consideration to the annual incentive payouts made to Mr. Mangas’ other direct reports but Mr. Schnaid’s performance with

respect to the goals described above had no material impact on Mr. Mangas’ evaluation, and as a result had no material impact on the final annual incentive payout

determined for, or awarded to, Mr. Schnaid. The annual incentive payout for Mr. Schnaid that was determined by Mr. Mangas (112% of target, for a payout of

$292,400) was subsequently communicated to, and reviewed by, the Compensation Committee.

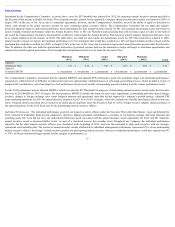

Annual awards made to our named executive officers with respect to 2015 performance are reflected in the 2015 Summary Compensation Table below in this

report.

2014 Special Cash Retention Award for Mr. Schnaid . In July 2014, the Compensation Committee provided a time-based retention bonus opportunity for

Mr. Schnaid in recognition of his assumption of Interim Chief Financial Officer duties and responsibilities while our Chief Financial Officer position remained

open. The special bonus opportunity was $255,496, which was equal to his target annual incentive opportunity (65% of his base salary). Half of the award was

earned for Mr. Schnaid’s service through the hiring of Mr. Mangas, and the remaining 50% of the award was earned for his service through the six-month period

following the payment of the first half of the award. In consultation with Meridian, the Compensation Committee determined that the form, design and amount of

this special retention bonus was fair and necessary to compensate Mr. Schnaid for agreeing to take on this additional role and responsibilities during 2014 given

that Mr. Schnaid’s other compensation elements were not adjusted during 2014 for this change in role and responsibilities. In February 2015, the Compensation

Committee increased the second portion of this award from $127,748 to $160,000 because of Mr. Schnaid’s excellent performance as Interim Chief Financial

Officer as well as the level at which he continued to perform his duties as Corporate Controller and Principal Accounting Officer while assisting Mr. Mangas in his

transition to Chief Financial Officer.

2014 One-Time Cash Retention Payment for Ms. Poulter . As an additional portion of Ms. Poulter’s new hire compensation package designed to attract and retain

her in her new position, in 2014 the Compensation Committee determined to award Ms. Poulter a one-time cash retention payment opportunity equal in value to

$1,500,000. This cash bonus was primarily intended to offset part of Ms. Poulter’s forfeited compensation from her prior employer. The amount of this cash

retention opportunity was determined by the Compensation Committee based on advice from Meridian as necessary and sufficient to attract and retain Ms. Poulter.

The cash retention payment will be paid to Ms. Poulter only if she remains employed with us for at least three years, subject to accelerated vesting for reasons

including termination by us without cause, Ms. Poulter’s disability or death or Ms. Poulter’s resignation for good reason in connection with a change in control of

the Company.

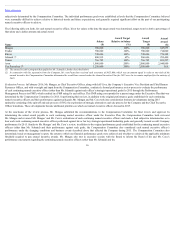

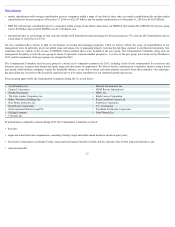

2015 Long-Term Incentive Compensation. Like the annual incentives described above, long-term incentives are generally a key part of our named executive

officer compensation program. Long-term incentive compensation for our continuing named executive officers for 2015 consisted entirely of equity compensation

awards granted in February 2015 under our LTIP following the announcement of our 2014 earnings, and these awards again consisted in substantial amount of

performance share awards. On average, approximately 57% of total compensation at target award levels for 2015 was equity-based long-term incentive

compensation. The Compensation Committee did not grant any long-term incentive equity awards to Messrs. Aron and van Paasschen in 2015.

In 2015, as in prior years, for all continuing named executive officers, the Compensation Committee used a grant approach in which the long-term award was

articulated as a dollar value. Under this approach, an overall award value was determined for each continuing named executive officer based upon our

compensation strategy and competitive market positioning. For 2015, these values were as follows: Mr. Mangas, $2,300,000; Ms. Poulter, $1,800,000; Mr. Rivera,

$1,800,000; Mr. Schnaid (determined prior to his assumption of the role of Chief Financial Officer), $400,000; and Mr. Turner, $2,300,000.

19