Starwood 2015 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2015 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

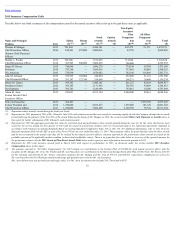

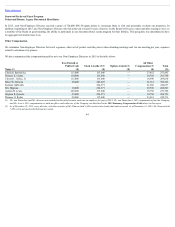

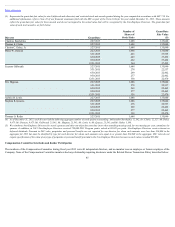

Termination on Account of Death or Disability. The following table discloses the amounts that would have become payable on account of a termination due to

death or disability on December 31, 2015.

Name

Severance

Pay

($)

Medical

Benefits

($)

Vesting of

Restricted

Stock

($) (1)

Vesting of

Performance

Shares

($) (2)

Vesting of

Stock

Options

($) (3)

Total

($)

Mangas — — 2,106,043 — — 2,106,043

Poulter 1,500,000 — 3,351,074 — — 4,851,074

Rivera — — 3,456,864 326,701 48,419 3,831,984

Schnaid — — 822,492 35,237 — 857,729

Turner 766,785 12,462 2,323,513 762,288 201,768 4,066,816

(1) Includesvaluesforholdingsofunvestedrestrictedstockandrestrictedstockunits.

(2) Represents the value of the performance shares based on actual performance as of December 31, 2015 (although the actual prorated payment would be based on

performanceforthefullperformanceperiod).

(3) Excludesthevalueofvestedstockoptions.

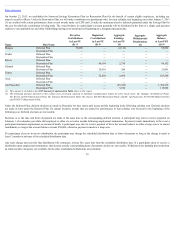

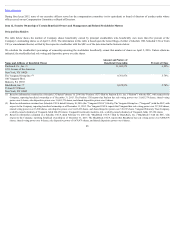

Change in Control. The following table discloses the amounts that would have become payable on account of an involuntary termination without cause following a

change in control or a voluntary termination with good reason following a change in control had each occurred on December 31, 2015.

Name

Severance

Pay

($)

Medical

Benefits

($)

Vesting of

Restricted

Stock

($) (1)

Vesting of

Performance

Shares

($) (2)

Vesting of

Stock

Options

($) (3)

Outplacement

($) (4)

Tax

Gross-Up

($)

Total

($)

Mangas 4,903,010 37,290 2,106,043 995,900 — 200,000 — 8,242,242

Poulter 5,000,000 37,290 3,351,074 779,400 — 140,000 — 9,307,763

Rivera (5) 3,678,685 33,412 3,456,864 1,822,895 48,419 149,939 — 9,190,214

Schnaid 1,698,817 22,680 822,492 126,782 — 100,000 — 2,770,771

Turner (5) 3,811,050 37,614 2,323,513 3,794,396 201,768 153,357 — 10,321,698

(1) Includesvaluesforholdingsofunvestedrestrictedstockandrestrictedstockunits.

(2) RepresentsthevalueoftheperformancesharesbasedonactualperformanceasofDecember31,2015(althoughtheactualpaymentwouldbebasedonperformanceforthe

fullperformanceperiod).

(3) Excludesthevalueofvestedstockoptions.

(4) Representsthemaximumamountpayableforoutplacementservices.

(5) Excludesdistributionsrelatedtononqualifieddeferredcompensationthatispayableupondeath,disabilityorcertainchangesincontrolasdiscussedinthesectionentitled

2015 Nonqualified Deferred Compensation Table aboveinthisreport.

Certain One Time Payments Upon Termination of Employment

Separation Agreement with Mr. van Paasschen. As described above, we entered into the van Paasschen Separation Agreement with Mr. van Paasschen pursuant to

which his employment continued until February 28, 2015 and he served as a consultant to the Company from March 1, 2015 through May 31, 2015. Under the

terms of the van Paasschen Separation Agreement, Mr. van Paasschen received certain payments and benefits in 2015, including payments and benefits that may

differ from those to which we were obligated to pay him under the terms of his employment agreement as described above.

During the Consulting Period, Mr. van Paasschen received a monthly consulting fee in the amount of $104,167, less all taxes and withholdings. Pursuant to the van

Paasschen Separation Agreement, we also paid Mr. van Paasschen on June 30, 2015 a lump sum severance payment equal to $7,187,500, which was a value equal

to two times base salary and two times target bonus less fees paid to him for his consulting fee. In addition, we paid

41