Starwood 2015 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2015 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

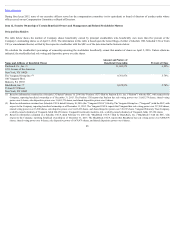

Mr. van Paasschen one-sixth of the annual incentive award the Compensation Committee determined he would have earned for 2015 under the Annual Incentive

Plan had he remained employed for the entirety of 2015, payable in accordance with and subject to the terms of our Annual Incentive Plan based on actual results

for fiscal year 2015. We also paid Mr. van Paasschen all accrued benefits, including his unpaid base salary earned, and any accrued and unpaid vacation pay, in

each instance, through February 28, 2015, his unpaid annual incentive award that he earned for 2014 (an amount equal to $1,875,000), and unreimbursed expenses.

In connection with Mr. van Paasschen’s right to continue participation in any group health care benefit plan sponsored by us at Mr. van Paasschen’s own expense

under COBRA, we have agreed to waive Mr. van Paasschen’s obligation to pay the 2% administrative charge for the first 24 months of such coverage. We paid

Mr. van Paasschen a lump sum payment of $25,256 in full satisfaction of our obligations under his employment agreement for certain COBRA-related payments.

Except with respect to the performance share awards granted to Mr. van Paasschen on February 28, 2013 (or the 2013 Award) and February 28, 2014 (or the 2014

Award, and together with the 2013 Award, the Performance Share Awards), following the ordinary course vesting of his outstanding compensatory equity awards

through February 28, 2015, Mr. van Paasschen has ceased vesting in and has forfeited all right, title and interest in or to all outstanding but unvested or unearned

equity awards, including but not limited to his stock options, restricted stock awards, and deferred units. With respect to each of the Performance Share Awards, at

the conclusion of the applicable three-year performance periods, when the Compensation Committee determines actual performance for each such award for

current employees, Mr. van Paasschen will then earn two-thirds of the number of shares that would otherwise have been earned under the 2013 Award based on

actual performance, and one-third of the number of shares that would otherwise have been earned under the 2014 Award, as determined based on actual

performance. To the extent Mr. van Paasschen has account balances under the Deferred Compensation Plan or the Savings Plan (as discussed in the section entitled

2015 Nonqualified Deferred Compensation Table above in this report), such balances will be distributed in accordance with such plans and any elections that

Mr. van Paasschen previously made with respect thereto.

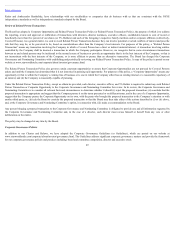

Mr. van Paasschen has agreed to release us, our affiliates and our and their directors, officers and employees from any claims that he may have against any of these

parties. Mr. van Paasschen also agreed that during the two-year period commencing from the effective date of the van Paasschen Separation Agreement, he will not

(1) acquire any of our equity securities, offer to enter into any merger or other business combination involving us or acquire voting control of us, or propose or

disclose any request for consent of any of the foregoing, (2) engage in any business that competes with us in any geographic area where we then conduct business,

or (3) solicit any of our employees or customers.

Separation Agreement with Mr. Aron. As described above, we entered into the Aron Separation Agreement with Mr. Aron pursuant to which his employment

continued until December 31, 2015. Under the terms of the Aron Separation Agreement, Mr. Aron received certain payments and benefits in 2015, including

payments and benefits that may differ from those to which we were obligated to pay him under the terms of his employment agreement as described above.

Pursuant to the Aron Separation Agreement, we paid Mr. Aron an annual incentive bonus for 2015 based on Mr. Aron’s target bonus for 2015 and calculated based

on the achievement of the applicable performance metrics for 2015 under the terms of the Executive Plan (the ultimate payout of which was $2,040,000). Under the

Aron Separation Agreement, Mr. Aron also became entitled to a grant of 70,019 shares of fully vested common stock in satisfaction of our obligation to make a

certain restricted stock award under the terms of Mr. Aron’s employment agreement. We also paid Mr. Aron all accrued benefits, including his unpaid base salary

earned, and any accrued and unpaid vacation pay, in each instance, through December 30, 2015, and unreimbursed expenses.

Mr. Aron has agreed to a general release of claims as a condition to the payment of the benefits and compensation described above (other than certain accrued

benefits and compensation). In addition, Mr. Aron

42