Starwood 2015 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2015 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

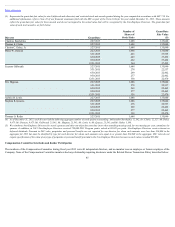

On October 22, 2013, we established the Starwood Savings Restoration Plan (or Restoration Plan) for the benefit of certain eligible employees, including our

named executive officers. Under the Restoration Plan, we will make contributions to participants who, for each calendar year beginning on or after January 1, 2013

(1) are credited with certain performance share or unit awards under our LTIP and (2) make the maximum elective deferrals permitted under the Savings Plan for

the year for which the contribution is being made. The vested balance in a participant’s account generally will be distributed in the form of a single cash payment

(subject to any applicable tax and other withholding) during a two-month period beginning on a designated payment date.

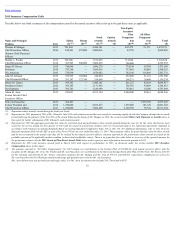

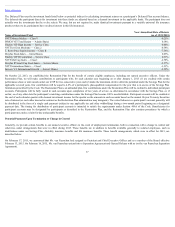

Name Plan Name

Executive

Contributions

in Last FY

($) (1)

Registrant

Contributions

in Last FY

($) (1)

Aggregate

Earnings

in Last FY

($)

Aggregate

Withdrawals/

Distributions

($)

Aggregate

Balance

at Last FYE

($) (2)

Mangas Deferred Plan 98,000 — (2,110) — 95,890

Restoration Plan — — — — —

Poulter Deferred Plan — — — — —

Restoration Plan — — — — —

Rivera Deferred Plan — — — — —

Restoration Plan — 49,184 2,730 — 99,162

Schnaid Deferred Plan — — — — —

Restoration Plan — 20,501 580 — 21,081

Turner Deferred Plan — — — — —

Restoration Plan — 52,024 2,898 — 105,280

Aron Deferred Plan — — — — —

Restoration Plan — — — — —

van Paasschen Deferred Plan — — (25,945) — 1,302,219

Restoration Plan — — 3,190 — 115,898

(1) Thisamountisincludedinthe2015 Summary Compensation Table aboveinthisreport.

(2) The following amounts reported in this column were previously reported in Summary Compensation Tables for prior fiscal years: Mr. Mangas, $0 (Deferred Plan);

Mr.Rivera,$45,683(RestorationPlan);Mr.Schnaid,$0(RestorationPlan);Mr.Turner,$48,689(RestorationPlan);andMr.vanPaasschen,$1,075,000(DeferredPlan)

and$108,973(RestorationPlan).

Under the Deferred Plan, deferral elections are made in December for base salary paid in pay periods beginning in the following calendar year. Deferral elections

are made in June under the Deferred Plan, for annual incentive awards that are earned for performance in that calendar year but paid in the beginning of the

following year. Deferral elections are irrevocable.

Elections as to the time and form of payment are made at the same time as the corresponding deferral election. A participant may elect to receive payment on

February 1 of a calendar year while still employed or either six or twelve months following employment termination. Payment is made immediately in the event a

participant terminates employment on account of death. A participant may elect to receive payment of his or her account balance in either a lump sum or in annual

installments, so long as the account balance exceeds $50,000; otherwise payment is made in a lump sum.

If a participant elects an in-service distribution, the participant may change the scheduled distribution date or form of payment so long as the change is made at

least 12 months in advance of the scheduled distribution date.

Any such change must provide that distribution will commence at least five years later than the scheduled distribution date. If a participant elects to receive a

distribution upon employment termination, that election and the corresponding form of payment election are irrevocable. Withdrawals for hardship that result from

an unforeseeable emergency are available, but no other unscheduled withdrawals are permitted.

36