Starwood 2015 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2015 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

– We broadly target total compensation opportunities at the median (50 th percentile) of the market for target performance levels; however, we also review

the range of values around the median, including out to the 25 th and 75 th percentiles. Despite our considerations of market benchmarks, we believe that

benchmarking alone does not provide a complete basis for establishing compensation levels or design practices under our programs.

– As a result, actual individual compensation may be above or below our targeted levels based on Company and individual performance, key responsibilities,

unique market demands, and experience level, as analyzed each year and as further described below.

• Motivate:We seek to motivate our executives to sustain high performance and achieve our financial and individual goals over the course of business cycles in

various market conditions. However, our compensation programs are designed not to encourage excessive risk taking, and we assess compensation-related risk

annually. In addition, we use multiple performance metrics, have caps on our incentive programs, require significant stock ownership by a number of executives,

and have a clawback policy that allows us to recoup incentives paid in the event of a financial restatement. See the section entitled Potential Impact on

Compensation for Executive Misconduct below in this report for more information.

• AlignInterests:We endeavor to align the investment interests of stockholders and the compensation interests of our executives by linking a significant portion

of the executive compensation to our annual business results and stock performance. Moreover, we strive to keep the executive compensation program

transparent, in line with market practices and consistent with the highest standards of corporate governance practices. The Compensation Committee’s decisions

in recent years to eliminate perquisite and excise tax gross-ups for new employment agreements, to adopt our anti-hedging and anti-pledging policies, and to

provide more of our named executive officers’ long-term incentive compensation in the form of performance-based awards have helped us achieve these goals

and better align compensation with the creation and preservation of stockholder value.

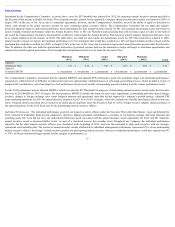

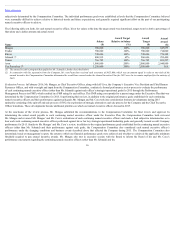

What the Program Intends to Reward. In general, our executive compensation program is strongly weighted towards variable compensation tied to our annual

business results and stock performance. Specifically, our compensation program for our named executive officers is designed to help ensure the following:

• Alignment with Stockholders: A significant portion of named executive officer compensation is delivered in the form of equity incentives with significant

performance or vesting requirements, ensuring that long-term compensation is strongly linked to stockholder returns. Further, our executive officers, including

most of our named executive officers, are (or were) required to own a specified amount of Company stock. See the section entitled Share Ownership Guidelines

below in this report for more information.

• AchievementofCompanyFinancialObjectives:A significant portion of named executive officer compensation is tied directly to our financial performance.

• AchievementofIndividualPerformance:Generally, a portion of our named executive officer compensation depends on individual performance evaluations

and the achievement of individual objectives that align with the execution of our business strategy, as well as demonstrated performance tied to our core

leadership competencies that include team building and the development of future talent. These objectives may be related to, among others, operational

excellence, brand enhancement, innovation, growth, cost containment/efficiency, customer experience and/or teamwork. See the section entitled Individual

Performance below in this report for more information on the key individual performance evaluations for the named executive officers other than Messrs. Van

Paasschen and Aron, as applicable, for 2015.

9