Starwood 2015 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2015 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

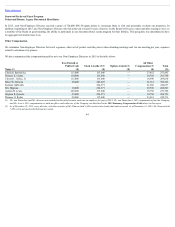

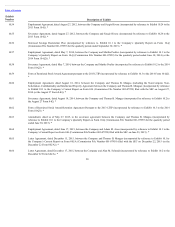

Equity Compensation Plan Information

The following table provides information as of December 31, 2015 regarding shares that may be issued under equity compensation plans maintained by the

Company:

Plan Category

Number of

Securities to be

Issued Upon

Exercise of

Outstanding

Options, Warrants

and Rights

(a)

Weighted-

Average Exercise

Price of

Outstanding

Options, Warrants

and Rights

(b)

Number of Securities

Remaining Available for

Future Issuance

Under Equity

Compensation Plans

(Excluding Securities

Reflected in Column (a))

(c)

Equity compensation plans

approved by security

holders 942,240 (1) $ 44.89 (2) 10,338,142 (3)

Equity compensation plans not approved

by security

holders — — —

TOTAL 942,240 $ 44.89 10,338,142

(1) Amount includes maximum estimated future payouts for the performance awards of 716,444 shares, and thus may overstate expected dilution.

(2) Weighted-average exercise price is representative of outstanding stock option awards only.

(3) All of these shares may be used for awards other than upon the exercise of an option, warrant or right. In addition, 9,631,558 shares remain available for issuance under our

Employee Stock Purchase Plan, a stock purchase plan meeting the requirements of Section 423 of the Code.

Item 13. Certain Relationships and Related Transactions, and Director Independence

Director Independence

In accordance with NYSE rules, the Board makes an annual determination as to the independence of the directors and director nominees. A director or director

nominee is not deemed independent unless the Board affirmatively determines that such director or director nominee has no material relationship with us, directly

or as an officer, stockholder or partner of an organization that has a relationship with us. The Board observes all criteria for independence established by the NYSE

listing standards and other governing laws and regulations. When assessing materiality of a director’s relationship with us, the Board considers all relevant facts

and circumstances, not merely from the director’s standpoint, but from that of the persons or organizations with which the director has an affiliation, and the

frequency or regularity of the services, whether the services are being carried out at arm’s length in the ordinary course of business and whether the services are

being provided substantially on the same terms to us as those prevailing at the time from unrelated parties for comparable transactions. Material relationships can

include any commercial, banking, consulting, legal, accounting, charitable or other business relationships each director or director nominee may have with us. In

addition, the Board consults with our external legal counsel to ensure that the Board’s determinations are consistent with all relevant securities laws and other

applicable laws and regulations regarding the definition of “independent director,” including but not limited to those set forth in pertinent listing standards of the

NYSE.

Our Board has determined that each of the directors except for Mr. Mangas is “independent” under the NYSE rules and that these directors have no material

relationship with us that would prevent the directors from being considered independent. In addition, it was taken into account that five of the non-employee

directors, Messrs. Daley, Duncan, Hippeau and Quazzo and Ms. Galbreath, have no relationship with us except as a director and stockholder of the Company and

that the remaining four non-employee directors, Messrs. Clarke, Lewis and

48