Starwood 2015 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2015 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Normal Course Performance-Based Equity Awards . The Compensation Committee approved the introduction of performance shares as a relative performance-

based equity vehicle for our named executive officers starting in 2013, and continued this practice in 2014 and 2015. These performance share awards are designed

to enhance our already strong “pay for performance” philosophy and help ensure that key executives’ interests are closely aligned with long-term stockholder

objectives and expectations. Our performance shares are designed to:

• Keep our long-term equity incentive program in line with best practices;

• Link executive reward opportunities to our performance, especially in relation to peer companies;

• Support global strategic business objectives, long-term growth and key metrics of performance;

• Reward behaviors that are in our best long-term interest;

• Meet external expectations of our stockholders; and

• Ensure we are delivering stockholder value creation.

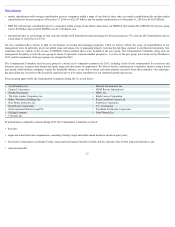

Performance shares represent an element of compensation for the continuing named executive officers that will be earned based on our performance relative to

peers in terms of total stockholder return, and thus by design significantly enhance our link between executive pay and Company performance for our stockholders.

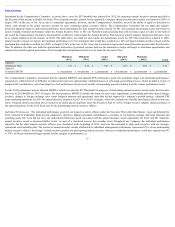

Performance shares will be earned and settled in shares at varying levels based on relative total stockholder return (or TSR) results over a three-year performance

cycle (2015 through 2017). If our performance relative to the specifically-defined peer group is in the bottom quartile, our continuing named executive officers will

not receive any payout for their performance shares. In addition, in the event that cumulative TSR is negative at the end of a performance cycle, payout will be

capped at 150% of target. Performance placing us between the 25 th percentile and 80 th percentile of a comparator group of companies defined in the performance

share grants will result in payout of between 0% and 200% of target. The table below outlines the level of payout resulting from varying levels of performance

between the 25 th and 80 th percentile (straight-line interpolation between levels):

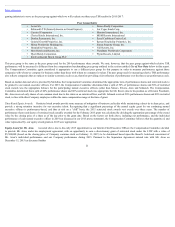

Percentile Ranking based on

Three-Year Relative TSR vs. Peer Group

Percent of Shares Earned

(% of target)

80 th or above 200%

65 th 150%

50 th (Median) 100%

35 th 50%

25 th or below 0%

Dividend equivalents will accrue during the performance cycle and will be credited in the same proportion on the performance shares but will be paid in cash only

after the performance cycle ends and only to the extent that performance shares are actually earned. For our 2015 performance share awards, upon advice from

Meridian, the Compensation Committee selected the following entities in the hospitality, real estate investment trust and

20