Starwood 2015 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2015 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

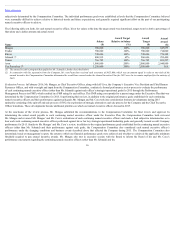

total compensation for them were established both above and below the 50 th percentile benchmark based on the Compensation Committee’s other evaluations

described below. Evaluated on this basis, the Compensation Committee believes the actual cash and equity compensation delivered for the 2015 performance year

for the continuing named executive officers was appropriate in light of our overall 2015 business performance described above and its evaluation of the

performance of the particular executives.

In addition, due to Mr. Aron assuming the role of Interim Chief Executive Officer for most of 2015, the Compensation Committee worked with its Chair and

management during the year to provide Mr. Aron with a separate executive compensation package to fairly compensate him for his efforts following Mr. van

Paasschen’s departure. We describe each of the compensation elements in more detail below and explain why we paid each element and how we determined the

amount of each element for 2015, including how certain compensation elements provided to Messrs. van Paasschen, Aron and Schnaid differ from those provided

to our other named executive officers.

2015 Base Salary

We believe it is essential to provide our named executive officers with competitive base salaries to attract and retain the critical senior executives needed to help

drive our success. Base salaries for our continuing named executive officers (other than Mr. Schnaid) and Mr. van Paasschen in 2015 were initially benchmarked at

the 50 th percentile against similar positions among a group of peer companies developed by management and approved by the Compensation Committee after

consultation with Meridian. The peer group consisted of similarly-sized hotel and property management companies as well as other companies representative of

markets in which we compete for key executive talent. See the section entitled Use of Peer Data below in this report for a list of the peer companies used in this

analysis.

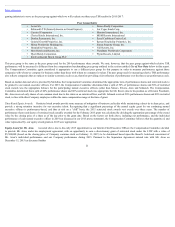

We generally seek to position base salaries of our named executive officers at or near the median base salary of our peer group for similar positions, but also review

the range of values around the median, including out to the 25 th and 75 th percentile, for reference purposes. See additional detail regarding base salaries in the

table below. In the case of Messrs. Mangas and Aron and Ms. Poulter, these base salary evaluations were conducted at the time those officers joined the Company.

Mr. Schnaid’s 2015 base salary was benchmarked in a manner substantially as described above, but because we did not expect his late 2015 promotion to Chief

Financial Officer, Mr. Schnaid’s pre-promotion base salary was determined based on the 50th percentile for similar corporate controller and principal accounting

officer positions as well as a review of the range of values around the median, including out to the 25th and 75th percentile, for reference purposes, among

companies with revenue in excess of $5 billion included in a general industry survey provided by Towers Watson, the Company’s external compensation

consultant. In the case of these companies, the survey utilized broad, industry-wide information and was a standard product offering of Towers Watson (rather than

any sort of survey gathering project specifically requested by us). For this evaluation purpose, no specific peer group was used, as it was the compensation data

produced by the survey information, rather than the identity of the individual companies participating in the survey, that was the most significant factor influencing

the ultimate decision made with respect to Mr. Schnaid’s 2015 base salary. In addition, we established base salaries with each of Messrs. Aron, Mangas and

Schnaid at the time they commenced serving as our Chief Executive Officer on an interim basis, Chief Executive Officer and Chief Financial Officer, respectively.

Base salaries for all continuing named executive officers (other than Messrs. Mangas and Schnaid) remained unchanged in 2015 from their 2014 annual rates. The

Compensation Committee decided not to raise the 2015 salaries of these named executive officers as a way to continue to manage overall compensation at the

median while taking into account the 25 th and 75 th percentile in accordance with its comparative analysis. Due to Mr. van Paasschen’s departure in early 2015, he

was not considered for a base salary increase. In connection with Mr. Mangas and Mr. Schnaid’s assumption of increased responsibilities as Chief Executive

Officer and Chief Financial Officer, respectively, each received an increase in 2016 base salary (effective as of December 31, 2015). On such date, Mr. Mangas’

base salary was increased to $1,000,000 (a 42.9% increase over his prior annual rate), and Mr. Schnaid’s base salary was increased to $500,000 (a 24.7% increase

over his prior annual rate).

12