Starwood 2015 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2015 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

or omission that constitutes fraud, dishonesty, breach of trust, gross negligence, civil or criminal illegality or other conduct or behavior that could subject us or any

of our affiliates to civil or criminal liability or otherwise adversely affect our and their business, interests or reputations; or (4) failure to accept a new position that,

if accepted, would not give Mr. Schnaid the right to initiate the termination of his employment for “good reason” (as defined in Mr. Schnaid’s retention letter).

“Good reason” for purposes of Mr. Schnaid’s retention letter generally means: (1) a material diminution in Mr. Schnaid’s authority, duties or responsibilities; (2) a

material diminution in Mr. Schnaid’s combined annual base salary and target annual incentive award, without a comparable increase in other target annual

compensation; or (3) relocation of Mr. Schnaid’s principal place of employment by more than 50 miles. If an event constituting good reason is alleged to exist, we

will be provided the opportunity to cure such alleged event. In the event that the bonus becomes payable as a result of Mr. Schnaid’s termination without “cause” or

resignation for “good reason,” receipt is subject to certain restrictive covenants and execution of a severance agreement with the Company, including a general

release of claims.

Benefits and Perquisites

Base salary and incentive compensation were supplemented for 2015 by limited benefits and perquisites, as described below.

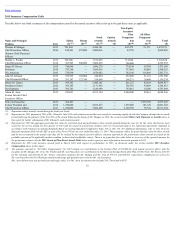

Perquisites. As reflected in the 2015 Summary Compensation Table below in this report, we provide certain limited perquisites to select named executive

officers when necessary to provide an appropriate compensation package, including in connection with enabling the executives and their families to smoothly

transition from previous positions which may require relocation. For example, prior to May 2015 Messrs. van Paasschen and Aron, our former President and Chief

Executive Officer and our former Interim Chief Executive Officer, respectively, were able to use our company airplane whenever reasonable for both personal and

business travel and our other named executive officers could use the airplane whenever air travel was required for business. Depending on availability, family

members of executive officers were permitted to accompany our executives on our company airplane. We also provided Messrs. van Paasschen and Aron with the

use of a driver and car service in the New York metropolitan area for business purposes (including commuting to and from work). The cost of these perquisites is

imputed as income to the executive and the incremental fair value for such travel is included in the “All Other Compensation” column in the 2015 Summary

Compensation Table below in this report. The executive is fully and personally responsible, however, for any associated tax liability under the terms of his

employment agreement or arrangement.

Retirement Benefits. We maintain a tax-qualified retirement savings plan pursuant to Code Section 401(k) (which plan we refer to as the Savings Plan) for a

broadly-defined group of eligible employees that includes the named executive officers. Eligible employees may contribute a portion of their eligible compensation

to the Savings Plan on a before-tax basis, subject to certain limitations prescribed by the Code. We match 100% of the first 1% of eligible compensation and 50%

of the next 6% of eligible compensation that an eligible employee contributes. These matching contributions, as adjusted for related investment returns, become

fully vested upon the eligible employee’s completion of two years of service with us. Our named executive officers, in addition to certain other eligible employees,

are permitted to make additional deferrals of base pay and regular annual incentive awards under our nonqualified deferred compensation plan under which

deferrals are not matched. Additionally, during 2013, we adopted a Savings Restoration Plan that provides certain eligible employees, including our named

executive officers, with a Company contribution of 4% of their annual plan-qualified earnings that are in excess of the Savings Plan limitations prescribed by the

Code. These plans are discussed in further detail under the section entitled 2015 Nonqualified Deferred Compensation Table below in this report.

Change in Control Arrangements

Under Company policy, we are required to seek stockholder approval of severance agreements with executive officers that provide “Benefits” (as defined in the

policy) in excess of 2.99 times base salary plus such officer’s most recent annual incentive award. All change in control arrangements entered into with our current

named

23