Starwood 2015 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2015 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

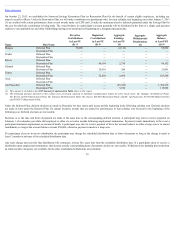

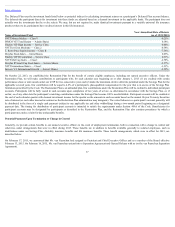

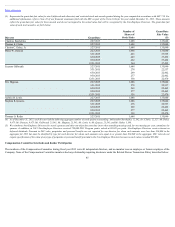

The Deferred Plan uses the investment funds listed below as potential indices for calculating investment returns on a participant’s Deferred Plan account balance.

The deferrals the participant directs for investment into these funds are adjusted based on a deemed investment in the applicable funds. The participant does not

actually own the investments that he or she selects. We may, but are not required to, make identical investments pursuant to a variable universal life insurance

product (when we do, participants have no direct interest in this life insurance).

Name of Investment Fund

Year Annualized Rate of Return

(as of 12/31/2015)

NVIT Money Market — Class V -0.25%

PIMCO VIT Total Return — Admin Shares 0.18%

Fidelity VIP High Income — Service Class -4.00%

NVIT Inv Dest Moderate — Class 2 -0.58%

T. Rowe Price Equity Income — Class II -7.34%

Dreyfus Stock Index — Initial Shares 0.85%

Fidelity VIP II Contrafund — Service Class 0.31%

NVIT Mid Cap Index — Class I -2.78%

Dreyfus IP Small Cap Stock Index — Service Shares -2.57%

NVIT International Index — Class I -1.21%

Invesco V.I. International Growth — Series I Shares -2.59%

On October 22, 2013, we established the Restoration Plan for the benefit of certain eligible employees, including our named executive officers. Under the

Restoration Plan, we will make contributions to participants who, for each calendar year beginning on or after January 1, 2013 (1) are credited with certain

performance share or unit awards under our LTIP for two consecutive years and (2) make the maximum elective deferrals permitted under the Savings Plan for the

applicable covered years. Our contribution will be equal to 4.0% of a participant’s plan-qualified compensation for the year that is in excess of the Savings Plan

limitations prescribed by the Code. The Restoration Plan is an unfunded plan. Our contributions under the Restoration Plan will be credited to individual participant

accounts. Participants will be fully vested in such accounts upon completion of two years of service, as determined in accordance with the Savings Plan, or, if

earlier, as of any other date the participant’s matching contributions under the Savings Plan become 100% non-forfeitable. Participant accounts will be credited at

the end of each calendar quarter with deemed investment income for the quarter on the amounts in such accounts based on the annual 30-year Treasury Securities

rate of interest (or such other deemed investment as the Restoration Plan administrator may designate). The vested balance in a participant’s account generally will

be distributed in the form of a single cash payment (subject to any applicable tax and other withholding) during a two-month period beginning on a designated

payment date. The timing for distribution of participant accounts is intended to satisfy the requirements under Section 409A of the Code. Beneficiaries for

participant accounts may be designated by participants as described in the Restoration Plan, and the Restoration Plan also contains procedures by which a

participant may make a claim for due and payable benefits.

Potential Payments Upon Termination or Change in Control

Generally, we provide certain benefits to our named executive officers in the event of employment termination, both in connection with a change in control and

otherwise, under arrangements that were in effect during 2015. These benefits are in addition to benefits available generally to salaried employees, such as

distributions under our Savings Plan, disability insurance benefits and life insurance benefits. These benefit arrangements, which were in effect for 2015, are

described below.

On February 17, 2015, we announced that Mr. van Paasschen had resigned as President and Chief Executive Officer and as a member of the Board effective

February 13, 2015. On February 16, 2015, Mr. van Paasschen entered into a Separation Agreement and General Release with us (or the van Paasschen Separation

Agreement).

37