Starwood 2015 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2015 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

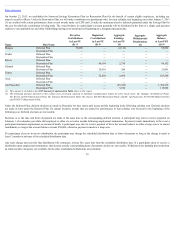

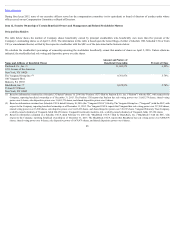

• continued medical benefits for two years (or, for Mr. Schnaid, 18 months);

• a lump sum amount, in cash, equal to the sum of (1) any unpaid incentive compensation which had been allocated or awarded to the executive for any measuring

period preceding termination under any annual or long-term incentive plan and which, as of the date of termination, is contingent only upon the continued

employment of the executive until a subsequent date, and (2) the aggregate value of all contingent incentive compensation awards allocated or awarded to the

executive for all then uncompleted periods under any such plan that the executive would have earned on the last day of the performance award period, assuming

the achievement, at the target level, of the individual and corporate performance goals established with respect to such award, prorated based upon the number

of days employed during such year;

• for Messrs. Rivera and Turner, subject to the terms of their equity awards, immediate vesting of stock options and restricted stock held by the executive, and for

Ms. Poulter and Messrs. Mangas and Schnaid, treatment of outstanding equity awards as specified by the applicable equity plan and corresponding award

agreements;

• outplacement services suitable to the executive’s position for a period of two years or, if earlier, until the first acceptance by the executive of an offer of

employment, the cost of which will not exceed 20% of the executive’s base salary;

• a lump sum payment of the executive’s deferred compensation paid in accordance with Section 409A of the Code distribution rules; and

• lump sum payment by us of an amount equal to any unvested amounts in the executive’s 401(k) account that are forfeited by reason of the executive’s

termination of employment.

No tax gross-up is provided if such payments become subject to excise tax under Section 4999 of the Code. If such payments are subject to the excise tax, the

benefits under the applicable agreement will be reduced until the point where it would be more advantageous for the executive to pay the excise tax rather than

reducing the benefits.

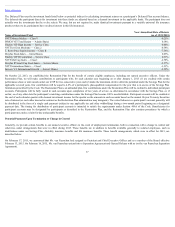

Under the severance agreements for Messrs. Turner and Rivera, a “Change in Control” is generally deemed to occur upon any of the following events:

• any person becomes the beneficial owner of our securities (not including in the securities beneficially owned by such person any securities acquired directly

from us or our affiliates) representing 25% or more of our combined voting power (subject to limited exceptions described in the agreements);

• a majority of the incumbent directors cease to serve on our Board (subject to limited exceptions related to a hostile proxy contest);

• consummation of a merger or consolidation of us or any of our direct or indirect subsidiaries with any other corporation, other than (1) a merger or consolidation

in which our securities would represent at least 70% of the voting power of the surviving entity; or (2) a merger or consolidation effected to implement a

recapitalization of the Company in which no person becomes the beneficial owner of 25% or more of our voting power; or

• approval of a plan of liquidation or dissolution by the stockholders or the consummation of a sale of all or substantially all of our assets, other than a sale to an

entity in which our stockholders would hold at least 70% of the voting power in substantially the same proportions as their ownership of us immediately prior to

such sale (however, a “Change in Control” does not include a transaction in which our stockholders continue to hold substantially the same proportionate

ownership in the entity which would own all or substantially all of our assets following such transaction).

39