Starwood 2015 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2015 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

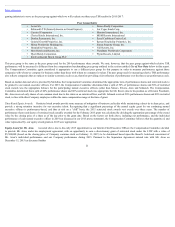

Table of Contents

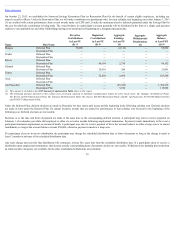

• Minimum Performance and Maximum Payout Levels for Annual Incentives: Each year our Compensation Committee establishes within the first 90 days a

threshold level of adjusted EBITDA that we must achieve in order for any annual incentive to be paid to our named executive officers or other Company

employees eligible to receive an annual incentive for any given year. The Executive Plan also specifies a maximum incentive amount, in dollars, that may be

paid to any executive officer for any 12-month performance period. In addition, under our design and operation of the Executive Plan, we have established

maximum incentive award amounts for the achievement of financial goals (200% of target awards for the portion of the awards relating to those goals (or 150%

in the case of Mr. Aron)) and individual goals (175% of target awards for the portion of the awards relating to those goals), which amounts are below the

maximum incentive amount specified under the Executive Plan. As a result of this threshold performance requirement and the design and operation of our

Executive Plan, incentive compensation is payable under our incentive plans only upon the attainment of performance targets related to business criteria that are

in the interests of our stockholders.

• Use of Long-Term Incentive Compensation: Equity-based long-term incentive compensation that vests over a period of years is a key component of total

compensation of our executive employees. This vesting period encourages our executives to focus on sustaining our long-term performance. These grants are

also made annually, so executives always have unvested awards that could decrease significantly in value if our business is not managed for the long-term.

• Share Ownership Guidelines: Our share ownership guidelines require our executive officers to hold that number of shares having a market value equal to or

greater than a multiple of each executive’s base salary. For Messrs. van Paasschen and Aron, the multiple was six times base salary, for Mr. Mangas (effective

upon his assumption of the role of Chief Executive Officer), the multiple is six times base salary, for Mr. Rivera, Division President, the multiple is three times

base salary, and for the other named executive officers other than Mr. Schnaid (including Mr. Mangas prior to December 31, 2015), the multiple is four times

base salary. This multiple is reduced by one times base salary, however, for executives that are retirement eligible. A retention requirement of 35% is applied to

restricted shares upon vesting (net shares after tax withholding) and shares obtained from option exercises until the executive meets the target, or if an executive

falls out of compliance. See the section entitled Share Ownership Guidelines above in this report for a description of the securities that count towards meeting

the target and other considerations.

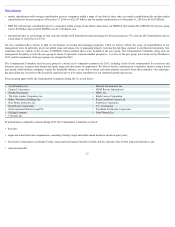

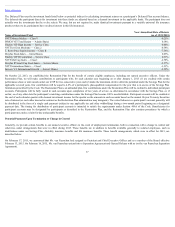

• Restrictions on Related Person Transactions: We have a corporate opportunity and related person transaction approval process regarding the review,

approval and ratification by our Corporate Governance and Nominating Committee of all transactions with related persons, executive officers, and their

respective family members and/or corporate affiliates. See the section entitled Certain Relationships and Related Transactions below in this report for a

complete description of this policy.

• Incentive Recoupment Policy: We have an incentive recoupment policy that allows us to recover any annual incentive payment or long-term incentive

payment to any individual executive at the senior vice president level and above, including our named executive officers, in the event of a financial restatement.

See the section entitled Potential Impact on Compensation for Executive Misconduct above in this report for more information.

• Anti-Hedging Policy: We have an anti-hedging policy that restricts all officers and directors from engaging in short sales, entering into any derivative

transactions, such as swaps, straddles, puts, or calls, or engaging in any hedging or monetization transactions, such as collars or forward sale contracts, that are

directly linked to our stock.

• Anti-Pledging Policy: We have an anti-pledging policy that restricts our directors and executive officers, including our named executive officers, from

pledging, hypothecating or otherwise encumbering our stock or equity securities as collateral for indebtedness.

30