Starwood 2015 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2015 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

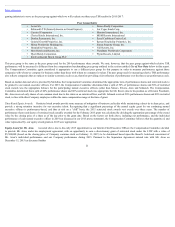

gaming industries to serve as the peer group against which we will evaluate our three-year TSR results for 2015-2017:

Peer Group Entity

• Accor SA • Kimco Realty Corporation

• Belmond LTD (formerly known as Orient Express) • Las Vegas Sands Corp.

• Carnival Corporation • Marriott International, Inc.

• Choice Hotels International, Inc. • MGM Resorts International

• Darden Restaurants, Inc. • Royal Caribbean Cruises Ltd.

• General Growth Properties, Inc. • Ryman Hospitality Properties, Inc.

• Hilton Worldwide Holdings Inc. • Simon Property Group, Inc.

• Hospitality Properties, Inc. • Vail Resorts, Inc.

• Host Hotels and Resorts, Inc. • Wyndham Worldwide Corporation

• Hyatt Hotels Corporation • Wynn Resorts, Limited

• InterContinental Hotels Group PLC

This peer group is the same as the peer group used for the 2014 performance share awards. We note, however, that the peer group against which relative TSR

performance will be measured is different from the compensation benchmarking peer group outlined in the section entitled Use of Peer Data below in this report.

The Compensation Committee again considered it appropriate to use a different peer group for this purpose in order to measure performance against those

companies with whom we compete for business rather than those with whom we compete for talent. The peer group used for measuring relative TSR performance

also reflects companies that are subject to similar economic cycles as us, therefore providing a fair reflection of performance over the three-year performance cycle.

Based on market data and advice provided by Meridian, the Compensation Committee determined the appropriate mix of performance shares and restricted stock to

be granted to our named executive officers. For 2015, the Compensation Committee determined that a split of 50% of performance shares and 50% of restricted

stock awards was the appropriate balance for the participating named executive officers (other than Messrs. Rivera, Aron and Schnaid). The Compensation

Committee determined that a split of 40% performance shares and 60% restricted stock was appropriate for Mr. Rivera (due to his position as a Division President),

Mr. Aron received only shares of our common stock due to his status as an interim officer, and Mr. Schnaid received 20% performance shares and 80% restricted

stock, in line with other Company employees within the same compensation range at the time of grant.

Time-BasedEquityAwards. Restricted stock awards provide some measure of mitigation of business cyclicality while maintaining a direct tie to share price, and

provide a strong retention incentive for our executive talent. Recognizing that a significant percentage of the annual equity grant for our continuing named

executive officers is performance-based, and thus at risk on a “cliff” basis, the 2015 restricted stock awards vest evenly over three years. The number of

performance shares and shares of restricted stock actually awarded for the February 2015 grant was calculated by dividing the appropriate percentage of the award

value by the closing price of a share as of the day prior to the grant date. Based on the factors set forth above, including our performance, and the individual

performance of each named executive officer in 2014 (as discussed in our 2015 proxy statement), the Compensation Committee believes that the quantity of, and

value represented by, our equity award grants in 2015 were appropriate.

Equity Award for Mr. Aron. As noted above, due to his early 2015 appointment as our Interim Chief Executive Officer, the Compensation Committee decided

to provide Mr. Aron, under his employment agreement, with an opportunity to earn a discretionary grant of restricted stock under the LTIP with a value of

$5,500,000 (based on the closing price of Company common stock on February 13, 2015) to be determined based upon the Board’s look-back assessment of

Mr. Aron’s individual performance and our Company performance during 2015. Pursuant to the Separation Agreement entered into with Mr. Aron on

December 15, 2015 (as discussed further

21