Starwood 2015 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2015 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

During fiscal year 2015, none of our executive officers served on the compensation committee (or its equivalent) or board of directors of another entity whose

officer served on our Compensation Committee or Board of Directors.

Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

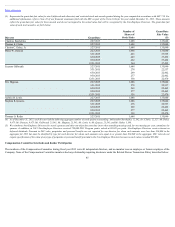

Principal Stockholders

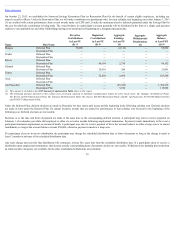

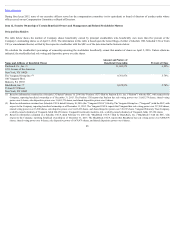

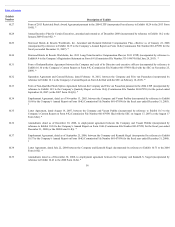

The table below shows the number of Company shares beneficially owned by principal stockholders who beneficially own more than five percent of the

Company’s outstanding shares as of April 5, 2016. The information in this table is based upon the latest filings of either a Schedule 13D, Schedule 13G or Form

13F (or amendments thereto) as filed by the respective stockholder with the SEC as of the date stated in the footnotes below.

We calculate the stockholder’s percentage of ownership assuming the stockholder beneficially owned that number of shares on April 5, 2016. Unless otherwise

indicated, the stockholder had sole voting and dispositive power over the shares.

Name and Address of Beneficial Owner

Amount and Nature of

Beneficial Ownership Percent of Class

Paulson & Co., Inc. (1)

1251 Avenue of the Americas

New York, NY 10020

11,603,379

6.88%

The Vanguard Group Inc. (2)

100 Vanguard Blvd.

Malvern, PA 19355

9,761,976

5.79%

BlackRock, Inc. (3)

55 East 52 nd Street

New York, NY 10005

9,678,976

5.74%

(1) Based on information contained in a Schedule 13G dated February 16, 2016 (the “Paulson 13G”) filed by Paulson & Co. Inc. (“Paulson”) with the SEC, with respect to the

Company, reporting beneficial ownership as of December 31, 2015. The Paulson 13G reports that Paulson has sole voting power over 11,603,379 shares, shared voting

power over 0 shares, sole dispositive power over 11,603,379 shares, and shared dispositive power over 0 shares.

(2) Based on information contained in a Schedule 13G/A dated February 10, 2016 (the “Vanguard 13G/A”) filed by The Vanguard Group Inc. (“Vanguard”) with the SEC, with

respect to the Company, reporting beneficial ownership as of December 31, 2015. The Vanguard 13G/A reports that Vanguard has sole voting power over 317,949 shares,

shared voting power over 16,900 shares, sole dispotive power over 9,423,229 shares, and shared dispotive power over 338,747 shares. Vanguard Fiduciary Trust Company,

a wholly-owned subsidiary of Vanguard, holds 264,650 shares. Vanguard Investments Australia, Ltd., a wholly-owned subsidiary of Vanguard, holds 127,396 shares.

(3) Based on information contained in a Schedule 13G/A dated February 10, 2016 (the “BlackRock 13G/A”) filed by BlackRock, Inc. (“BlackRock”) with the SEC, with

respect to the Company, reporting beneficial ownership as of December 31, 2015. The BlackRock 13G/A reports that BlackRock has sole voting power over 8,088,578

shares, shared voting power over 0 shares, sole dispositive power of 9,678,976 shares, and shared dispositive power over 0 shares.

46