Square Enix 2012 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2012 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

52

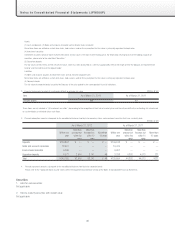

Notes to Consolidated Financial Statements (JPNGAAP)

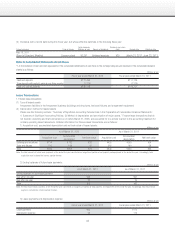

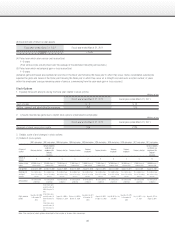

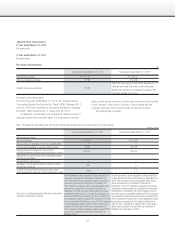

2. A reconciliation of the statutory tax rate and the effective tax rate is as follows:

As of March 31, 2012

Statutory tax rate

40.70%

(Adjustments)

Permanent differences relating to entertainment expense, etc., excluded from non-taxable expenses 0.65

Permanent differences relating to dividends received, etc., excluded from non-taxable expenses (0.17)

Valuation allowance (2.38)

Taxation on a per capita basis for inhabitants’ tax 1.13

Tax credit for R&D expenses (11.36)

Reduction of deferred tax assets and liabilities at fiscal year-end due to changes in corporate tax rate 5.13

Foreign tax credit 3.19

Differences in tax rate from the parent company’s statutory

tax rate 0.55

Other 1.00

Effective tax rate 38.44

No breakdown of key components is presented for the fiscal year ended March 31, 2011 because the Company posted a loss before income taxes and

minority interests.

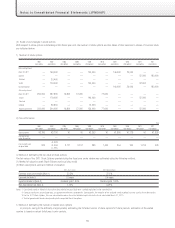

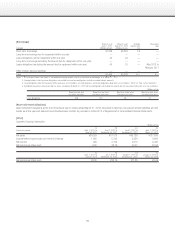

3. Reduction of deferred tax assets and deferred tax liabilities due to changes in tax rate

Following promulgation of the “Law to revise a part of the income tax law and other laws to build the tax system in response to structural changes in the

economy of Japan” (Law No. 114 of 2011) and the “Law on special measures related to securing financial resources necessary to execute programs for

recovery from the Great East Japan Earthquake” (Law No. 117 of 2011) on December 2, 2011, a reduction in the corporate tax rate and the introduction

of a special tax to be applied to reconstruction costs will become effective from fiscal years beginning on or after April 1, 2012. Along with these

changes, the statutory tax rate used in calculating deferred tax assets and deferred tax liabilities will decrease from the current 40.70% to 38.01%

concerning temporary differences expected to be resolved in the fiscal years beginning between April 1, 2012 and April 1, 2014, and to 35.64%,

concerning temporary differences expected to be resolved in fiscal years beginning on or after April 1, 2015. Due to these tax rate changes, the amount

of deferred tax assets (net of deferred tax liabilities) decreased by ¥495 million and income taxes–deferred increased by ¥504 million as of and for the

fiscal year ended March 31, 2012.

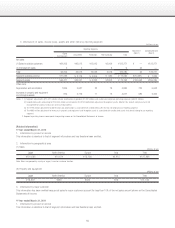

Business Combinations

■ Year ended March 31, 2012

Not applicable

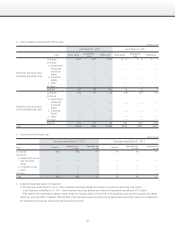

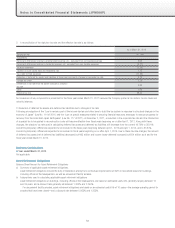

Asset Retirement Obligations

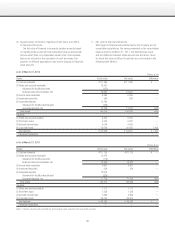

Balance Sheet Amount for Asset Retirement Obligations

a) Summary of applicable asset retirement obligations

Asset retirement obligations include the duty of restoration arising from contractual requirements set forth in real estate leases for buildings,

including offices at the headquarters, as well as amusement facility arcades.

b) Assumptions used in calculating applicable asset retirement obligations

Asset retirement obligations on buildings, including offices at the headquarters, are based on estimated useful life, generally ranging between 10

and 24 years, and a discount rate generally set between 1.300% and 2.240%.

For amusement facility arcades, asset retirement obligations are based on an estimated useful life of 10 years—the average operating period for

arcades that have been closed—and a discount rate between 0.955% and 1.355%.