Square Enix 2012 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2012 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

46

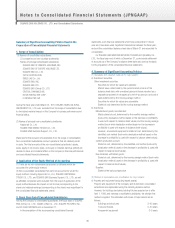

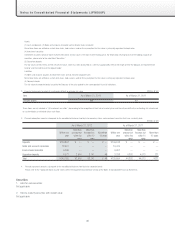

Notes to Consolidated Financial Statements (JPNGAAP)

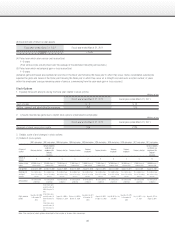

Assets

(1) Cash and deposits, (2) Notes and accounts receivable and (3) Income taxes receivable

Since these items are settled on a short-term basis, book value is used on the assumption that fair value is principally equivalent to book value.

(4) Investment securities

Investment securities comprise stock market listed shares and fair value is the stock-market trading price. For information relating to each of the holding purposes of

securities, please refer to the note titled “Securities.”

(5) Guarantee deposits

The fair values of these items are the net present value, which has been discounted at a rate that appropriately reflects the length of time the deposits are expected to be

held for and the credit risk of the deposit holder.

Liabilities

(1) Notes and accounts payable, (2) Short-term loans and (3) Accrued corporate taxes

Since these items are settled on a short-term basis, book value is used on the assumption that fair value is principally equivalent to book value.

(4) Corporate bonds

The fair value of corporate bonds issued by the Company is the price quoted by the correspondent financial institutions.

2. Financial instruments for which it is extremely difficult to estimate fair value

These items are not included in “(4) Investment securities” above owing to the recognition of their lack of market prices and the extreme difficulty in estimating fair value based

on such methods as estimated future cash flows.

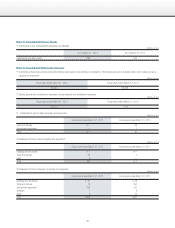

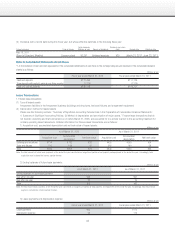

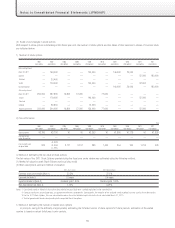

3. Planned redemption amounts subsequent to the consolidated balance sheet date for monetary claims and investment securities that have a maturity date

Millions of yen

As of March 31, 2012 As of March 31, 2011

Within one

year

More than

one year but

within five

years

More than

five years but

within 10

years

More than

10 years

Within one

year

More than

one year but

within five

years

More than

five years but

within 10

years

More than

10 years

Deposits ¥109,863 ¥ ─ ¥ ─ ¥

─¥109,618 ¥ ─ ¥ ─ ¥

─

Notes and accounts receivable 18,431 ─ ─ ─15,474 ─ ─ ─

Income taxes receivable 6,396 ─ ─ ─6,907 ───

Guarantee deposits 6,073 2,916 3,747 48 3,788 4,392 4,013 121

Total ¥140,765 ¥2,916 ¥3,747 ¥ 48 ¥135,664 ¥4,392 ¥4,013 ¥121

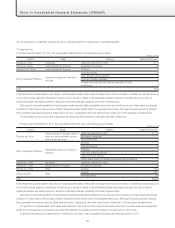

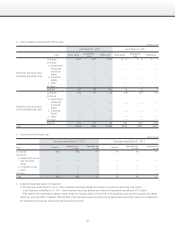

4. Planned repayment amounts subsequent to the consolidated balance sheet date for corporate bonds

Please refer to the “Corporate Bonds Issued” tables within the Supplementary Schedule section of the Notes to Consolidated Financial Statements.

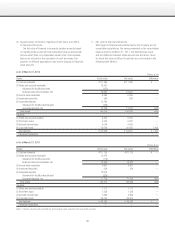

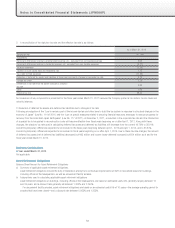

Securities

1. Held-for-sale securities

Not applicable

2. Held-to-maturity securities with market value

Not applicable

Millions of yen

Item As of March 31, 2012 As of March 31, 2011

Unlisted shares ¥

49

¥

51