Square Enix 2012 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2012 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

38

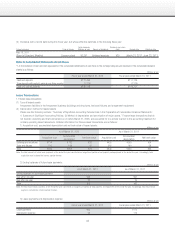

Notes to Consolidated Financial Statements (JPNGAAP)

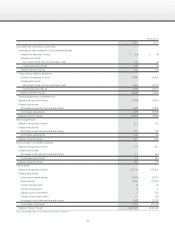

Changes in Accounting Policy

(Application of accounting standard for net income per share)

From the fiscal year ended March 31, 2012, the Company applies

“Accounting Standard for Earnings Per Share” (ASBJ Statement No. 2, issued

June 30, 2010) and “Guidance on Accounting Standard for Earnings Per

Share” (ASBJ Guidance No. 4, issued June 30, 2010).

Consequently, the Company has changed the method by which it

calculates diluted net income per share. For stock options that vest after

a certain period of service, the fair value of service to be provided to the

Company in the future is included in the proceeds that the Company assumes

it will receive through the exercise of rights.

The impact of this change is described in Per Share Information.

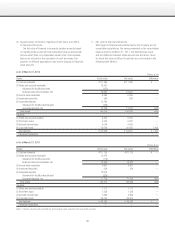

Reclassifications

(Consolidated Statements of Income)

“Commission fee,” which was included in “Miscellaneous loss” under “Non-

operating expenses” in the fiscal year ended March 31, 2011, is presented

separately as of the fiscal year ended March 31, 2012, because the amount

exceeded 10 percent of total non-operating expenses. To reflect this change

in the method of presentation, the consolidated financial statements for the

fiscal year ended March 31, 2011, have been reclassified.

Consequently, the ¥73 million recorded for “Miscellaneous loss”

under “Non-operating expenses” on the Consolidated Statement of Income

for the fiscal year ended March 31, 2011, has been broken down to

reveal specifically ¥44 million for “Commission fee” and ¥28 million for

“Miscellaneous loss.”

“Loss on disaster” was presented separately under “Extraordinary loss”

in the fiscal year ended March 31, 2011, but is included under “Other” as

of the fiscal year ended March 31, 2012, due to reduced significance as

the amount fell below 10 percent of total extraordinary loss. To reflect this

change in the method of presentation, the consolidated financial statements

for the fiscal year ended March 31, 2011, have been reclassified.

Consequently, the ¥570 million in “Loss on disaster” recorded under

“Extraordinary loss” on the Consolidated Statement of Income for the fiscal

year ended March 31, 2011, has been incorporated into “Other.”

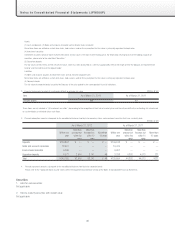

(Consolidated Statements of Cash Flows)

“Reversal of foreign currency translation adjustments,” a separate item under

“Cash flows from operating activities” in the fiscal year ended March 31,

2011, was included within “Other, net” in the fiscal year ended March 31,

2012, because of its reduced monetary significance. To reflect this change

in the method of presentation, the consolidated financial statements for the

fiscal year ended March 31, 2011, have been reclassified.

Consequently, the gain of ¥317 million from foreign currency translation in

the fiscal year ended March 31, 2011, has been incorporated into “Other, net.”

“Increase (decrease) in accrued consumption taxes,” a separate

item under “Cash flows from operating activities” in the fiscal year ended

March 31, 2011, was included within “Increase (decrease) in other current

liabilities” in the fiscal year ended March 31, 2012, because of its reduced

monetary significance. To reflect this change in the method of presentation,

the consolidated financial statements for the fiscal year ended March 31,

2011, have been reclassified.

Consequently, the ¥2,421 million recorded as a decrease in accrued

consumption taxes under “Cash flows from operating activities” in the fiscal

year ended March 31, 2011, has been incorporated into “Increase (decrease)

in other current liabilities.”

“Decrease in short-term loans payable,” a separate item under “Cash

flows from financing activities” in the fiscal year ended March 31, 2011,

is presented as “Increase (decrease) in short-term loans payable” in the

fiscal year ended March 31, 2012. To reflect this change in the method of

presentation, the consolidated financial statements for the fiscal year ended

March 31, 2011, have been reclassified.

Consequently, the ¥1,325 million recorded as a decrease in short-term

loans payable under “Cash flows from financing activities” in the fiscal year

ended March 31, 2011, has been included within “Increase (decrease) in

short-term loans payable” for the fiscal year ended March 31, 2012.

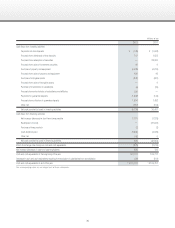

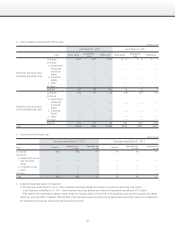

Changes in Accounting Estimates

(Change in Estimate for Asset Retirement Obligations)

The Company and some of its consolidated subsidiaries made the decision

in the fiscal year ended March 31, 2012, to relocate the head office as well

as offices within the vicinity of the head office building in the next fiscal year,

ending March 31, 2013. Consequently, because a more precise estimate

of asset retirement obligations could be determined, the Company changed

the asset retirement obligations estimate that had been booked to address

obligations that are incurred to restore premises to their original state at the

time of leaving, in accordance with the respective real estate lease contracts

for these buildings.

Consequently, consolidated operating income, ordinary income and

income before income taxes and minority interests are ¥508 million higher

for the fiscal year ended March 31, 2012.

Additional Information

(Application of Accounting Standard for Accounting Changes and Error

Corrections)

Effective April 1, 2011, the Company has applied “Accounting Standard

for Accounting Changes and Error Corrections” (ASBJ Statement No. 24,

December 4, 2009) and “Guidance on Accounting Standard for Accounting

Changes and Error Corrections” (ASBJ Guidance No. 24, December 4, 2009)

for accounting changes and corrections of prior period errors.