Square Enix 2012 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2012 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

40

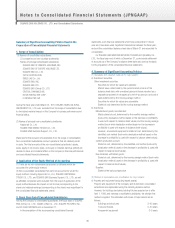

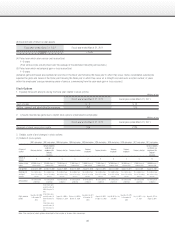

Notes to Consolidated Financial Statements (JPNGAAP)

*6 Loss on evaluation of investment securities was due to a significant decline in market prices of marketable securities.

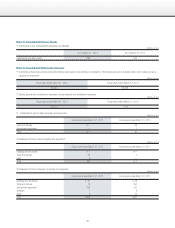

*7 Impairment loss

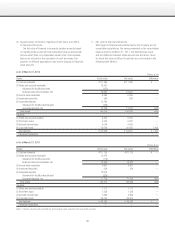

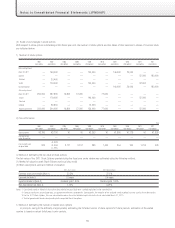

In the fiscal year ended March 31, 2012, the Group posted impairment loss on the following groups of assets.

Millions of yen

Location Usage Category Impairment amount

Shibuya-ku, Tokyo Idle assets Telephone subscription rights ¥ 6

Shibuya-ku, Tokyo Assets planned for disposal Amusement equipment 23

Moriguchi-shi, Osaka Assets planned for disposal Buildings 58

Ebina, Kanagawa Prefecture Amusement equipment production

and sale

Tools and fixtures 23

Other (Property and equipment) 9

Long-term prepaid expenses 0

Finance lease that does not transfer ownership of rental

transactions 9

Total ¥130

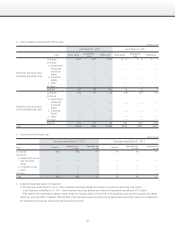

In the Amusement business segment, each division, including captive outlets, rented outlets and equipment production and sales, is classified as one asset-grouping

unit. In other business segments, classification of asset groups is carried out based on the relationships between businesses. Idle assets that are not used for

operational purposes and assets planned for disposal are classified individually, separately from those mentioned above.

With regard to idle assets presented in the table above, market value had fallen substantially below book value and the future use of these assets was deemed

uncertain. For these reasons, the book value of these idle assets has been written down to the applicable market value. With regard to assets planned for disposal,

their recoverable value was recognized as falling below book value. Consequently, their book value has been written down to the applicable recoverable value.

The recoverable amounts are primarily measured at net selling price which is based on reasonably estimated market prices.

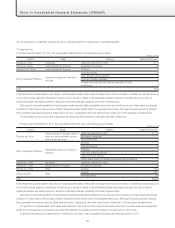

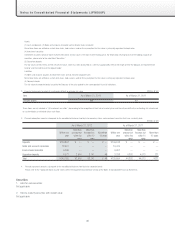

In the fiscal year ended March 31, 2011, the Group posted impairment loss on the following groups of assets. Millions of yen

Location Usage Category Impairment amount

Shinjuku-ku, Tokyo

Assets planned for disposal related to

home-use online karaoke business

(discontinued business)

Telephone subscription rights ¥ 10

Amusement equipment 1

Tools and fixtures 1

Ebina, Kanagawa Prefecture Amusement equipment production

and sale

Buildings 0

Tools and fixtures 45

Software 4

Long-term prepaid expenses 0

Leased tools and fixtures 13

Finance leases that do not transfer ownership of rental transactions 13

Shibuya-ku, Tokyo Idle assets Telephone subscription rights 2

Shibuya-ku, Tokyo Assets planned for disposal Amusement equipment 94

Shibuya-ku, Tokyo Other Goodwill 3,574

United Kingdom Other Goodwill 4,841

Intangible assets 248

Total ¥8,853

In the Amusement business segment, each division, including captive outlets, rented outlets and equipment production and sales, is classified as one asset-grouping

unit. In other business segments, classification of asset groups is carried out based on the relationships between businesses. Idle assets that are not used for

operational purposes and assets planned for disposal are classified individually, separately from those mentioned above.

With regard to idle assets presented in the table above, market value had fallen substantially below book value and the future use of these assets was deemed

uncertain. For these reasons, the book value of these idle assets has been written down to the applicable market value. With regard to assets planned for disposal,

their recoverable value was recognized as falling below book value. Consequently, their book value has been written down to the applicable recoverable value.

For goodwill and intangible assets, asset values were reassessed, taking into account changes in the market environment, and book values were subsequently

written down to the applicable recoverable values. Note that calculation of recoverable amounts is based on net selling price or value in use.

In principle, net selling price is based mainly on market price, and value in use is calculated using future cash flows discounted at 10.5%.